Protect your brand reputation

When your banks reputation is under attack, time is of the essence. A fast and accurate response is the most effective way of mitigating the potential impact of a crisis. At risk is customer trust, and every minute counts.

New reality for banks

In recent years, unprecedented economic conditions, technological change and system-wide shocks such as the Silicon Valley Bank collapse have put the reputation of banks in the spotlight. Social media amplifies harmful narratives and can drive crises of confidence in banking institutions at lightning speed and overwhelm mitigation strategies. As a result, your in-house teams go into overdrive, oftentimes without the resources to do so.

With Crisp’s reputation monitoring solution, banks can get ahead of emerging risks, mitigating the impact of a crisis and gain valuable time to understand the situation and act quickly.

Protect your bank’s reputation, fast

Even banks with the best reputations are not safe from harmful content on social media. With the rise of social media and review platforms, a single consumer complaint can undermine your reputation.

Our reputation monitoring solution provides the widest coverage and gives you the essential intelligence to stay informed and take action, immediately.

“When it comes to crisis monitoring, you need people that speak the language. You need people that understand the context of the country or region. You need people working in different time zones.”

Communications Manager

Banking Industry

FSQS Registered

FSQS (Financial Services Qualification System) is a community of financial institutions including banks, building societies, insurance companies and investment services, collaborating to agree a single standard for managing the increasing complexity of third and fourth-party information needed to demonstrate compliance to regulators, policies and governance controls

A complete solution for banks

Talk to our expertsCritical insights that enhance brand reputation, efficiently

Your partner in a crisis

When a crisis hits, it strains internal teams and understanding the situation costs valuable time. With the combination of AI and highly skilled human teams who can scale immediately to support you, huge quantities of information can be collected, processed and reported to your team, in real-time.

Comprehensive, real-time understanding of critical issues, narratives and actors allows your team to focus on dealing with the crisis.

Real-time monitoring of digital character

Even banks with good reputations are not safe from negative reviews online. Take action before a crisis hits, based on the impending risk of digital chatter.

Crisp provides an unparalleled collection of digital chatter beyond mainstream social media, including surface, deep and dark web, and uncovering the source of key narratives with real-time monitoring.

Around-the-clock alerts

Strategic 24/7 alerts prioritize and contextualize key risks, ensuring timely information for key stakeholders in a format tailored to their needs, with nuanced reports that delve deeper into evolving risks for informed decision-making.

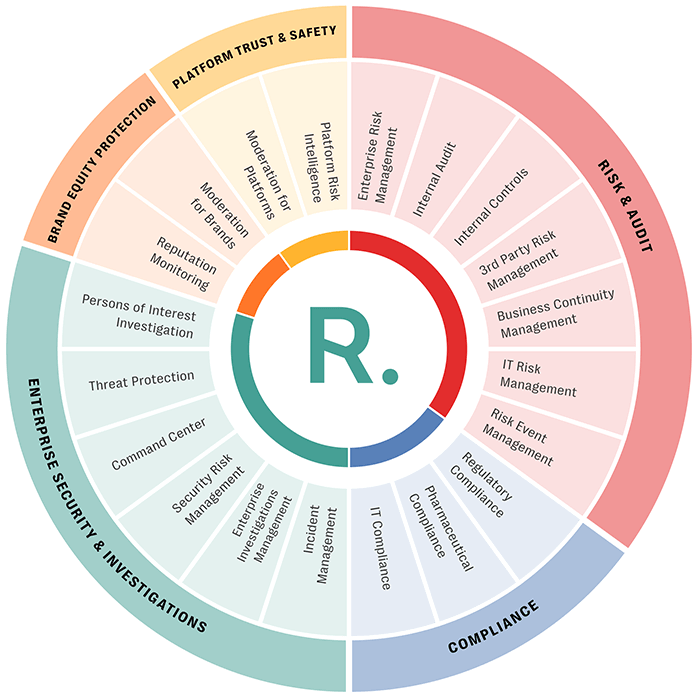

Whatever your needs, Resolver has a solution.

Enhance your defence

Your trusted partner to provide visibility, keep you informed and help you manage your reputation