Risk & Compliance Solutions for Asset Managers

Tailored for asset management firms, our technology and advisory services seamlessly integrate to optimize risk, compliance, and audit management. See how Resolver simplifies asset management compliance.

Proven impact of using Resolver’s risk and compliance software

Simplifying Risk & Compliance Complexity for Asset Managers

Regulatory Change Risk

Regulatory Change Risk

Rapid SEC and global regulatory changes in asset and wealth management demand swift adaptation. Manual risk and compliance monitoring is time-consuming and creates gaps, leaving your firm vulnerable to penalties, fines, and reputational damage.

Learn more about our Regulatory Compliance Management Solution

Fragmented Risk Management

Fragmented Risk Management

Without a unified risk management system, risks often go unnoticed, and departments work in silos. This leads to inconsistent standards, ineffective risk mitigation, and delayed decision-making.

Unseen Employee and Operational Activity

Unseen Employee and Operational Activity

Employee activities move fast and often escape notice, creating substantial compliance gaps and exposing your firm to potential risks and costly fines. Scattered data across various platforms compounds the challenge, making full visibility crucial yet difficult to achieve.

See how Ninety One modernized asset management with Resolver’s enterprise GRC solutions

Periodic Audits

Periodic Audits

Periodic audits often miss emerging issues. Outdated technology and manual processes slow down response times, hindering quick action on new risks.

Boost your risk and compliance program with scalable, adaptive solutions

Imagine the impact of intelligent automation combined with world-class risk and compliance expertise. Resolver and Kroll provide integrated risk and compliance solutions that transform your risk programs with advanced technology and expert insights.

Easily Scale Operations as Your Firm Grows

Our platform, built on risk and compliance industry best practices, offers flexible, no-code tailoring to fit your firm’s risk taxonomy and register design. Start with the features you need and easily adapt as needs evolve.

Stay Ahead of Regulatory Change

Resolver connects risks to requirements, helping your team anticipate threats with real-time regulatory alerts, while reducing manual tracking and non-compliance risks. Kroll’s award-winning experts offer regulatory and compliance support, guiding investment advisers through even the toughest compliance challenges.

Streamline Your Risk Approach

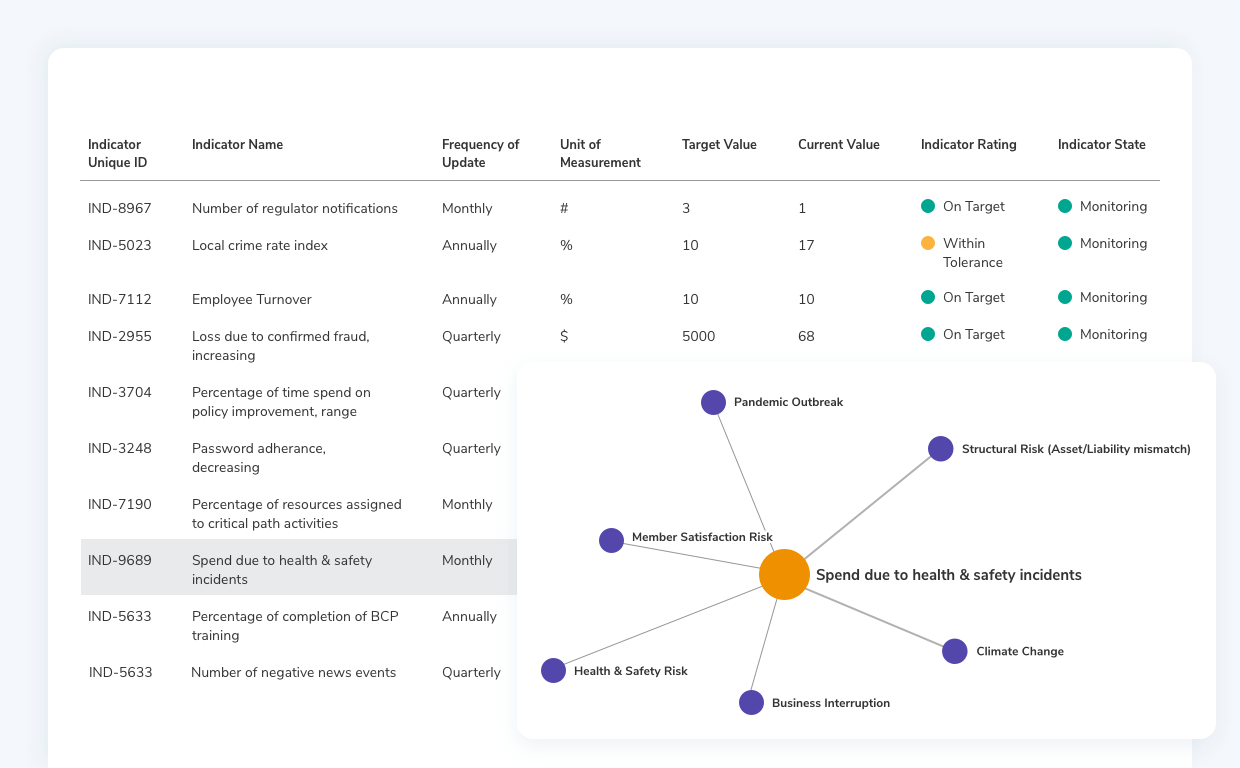

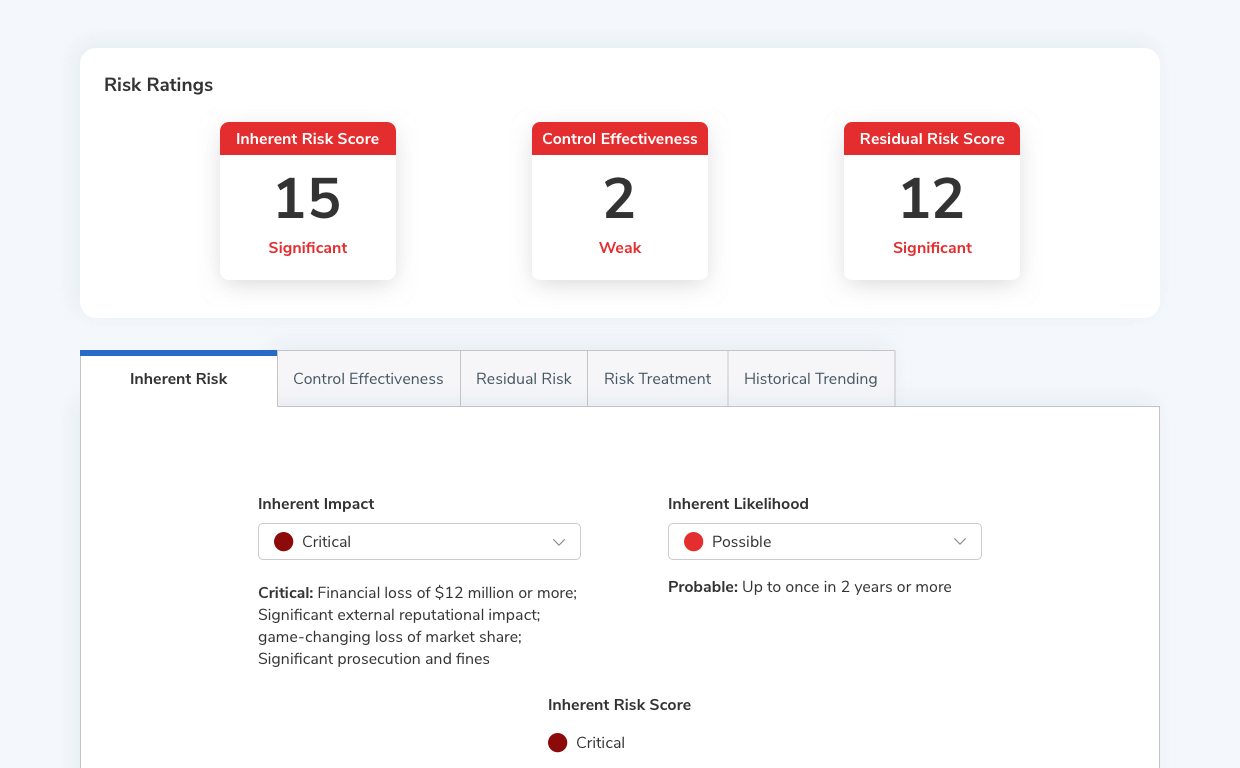

Standardize risk assessments across the firm with Resolver’s intuitive, automated workflows. Monitor key response indicators, engage risk owners and capture and assess risk or loss events in real-time with supportive tools.

Accelerate Your Audits

Enable continuous monitoring of controls with Resolver’s efficient audit plans, control testing and issue management. Speed up your workflow with a streamlined content library of processes, controls and tests, along with collaborative tools for cross-team engagement and fieldwork.

See How Resolver Transforms Risk and Compliance for Asset Managers

Schedule a demoUnderstand the impact of all risks across your firm

Enhance Team Collaboration Across All Lines of Business

Integrate risk, compliance, and audit functions in a single Risk Intelligence platform, improving collaboration across your entire organization.

- Centralized data repository: Map regulatory obligations to new and existing risks and controls, creating a single source of truth for all risk-related information.

- Cross-functional collaboration: Streamline the flow of critical risk information between risk owners, compliance teams, and leadership for proactive, enterprise-wide risk management.

- Improved accountability: Establish a strong risk data governance and issue reporting framework with clear lines of responsibility. Build confidence with regulators and executive management.

Make Compliance Your Competitive Edge

Stay ahead of regulatory changes and cut down on manual tracking with Resolver’s automated compliance monitoring.

- AI-powered regulatory library: Stay up to date with an intelligent, always-current database of global and U.S. regulatory content from SEC, FINRA, FCA, and ESMA.

- Automated policy updates & alerts: Link policies to regulations, triggering notifications and updates to policy owners as changes occur.

- Expert-led compliance testing: Leverage Kroll’s compliance testing expertise for annual reviews and gap analysis.

Align Risk Management with Business Objectives

Empower strategic alignment with detailed risk analytics, enabling proactive, data-driven decisions that support your firm’s goals.

- Targeted mitigation: Map risks to corporate objectives, focusing resources on key areas that directly impact business goals.

- 360° risk visibility: Consolidate all risk data to better identify, assess, monitor, and mitigate risks proactively.

- Industry best-practices: Leverage pre-configured forms built on COSO and ISO 31000 principles, for reliable risk assessments and reporting.

Enhance Audit Efficiency and Control

Easily analyze risk exposure with up-to-date firm-wide data and prevent escalation through proactive risk identification.

- Simplify fieldwork collaboration: Boost collaboration with an easy-to-use portal that simplifies document submission, process narratives, and test procedure results.

- Efficient testing coordination: Reduce duplication by using a single platform to upload, review work papers and centralize data.

- Financial reporting compliance: Empower your teams with ready-made templates that incorporate International Professional Practices Framework (IPFF) performance standards: coverage planning, fieldwork, testing, review and reporting steps.

See Why Resolver is the Trusted Choice for Industry Leaders

How motusbank Manages Compliance, Reduces Errors, and Cuts Costs Using Resolver

How Grow Financial Aligned Risk Management with Corporate Objectives & Embedded Risk in their Overall Culture

How Bangor Savings Bank Used Resolver to Improve ERM Process Efficiency & Collaboration with Risk Owners

See Our Risk & Compliance Software in Action

Discover how Resolver's advanced risk and compliance software can transform your asset management processes.