Alongside raising import costs, the implementation of the 2025 U.S. Tariff package has fundamentally rewired the risk landscape for multinational brands. The package combines a universal 10% import levy with additional country-specific tariffs and targeted sectoral duties.

As the implementation of the trade package evolves, businesses are already facing a widening set of ancillary risks. This includes rising operational costs, supply chain disruption, changing global consumption patterns, reputational backlash and heightened regulatory scrutiny.

Today, tariffs are more than a trade issue; they’re a reputational flashpoint. In this uncertain trade environment, pricing decisions, sourcing shifts, and even silence can trigger reputational backlash and boycott calls. For comms leaders, this moment demands more than a reactive playbook.

Protecting your brand from such risks calls for real-time and issue-specific risk intelligence that cuts through the noise, tracks emerging threats and informs confident decision-making before public sentiment hardens into lasting brand damage.

What’s driving brand risk from tariffs in 2025

The implementation of the 2025 U.S. Tariff package has already created economic disruption in the form of higher costs, delayed shipments, and disrupted sourcing. However, its reputational consequences are escalating faster and less predictably.

Beyond growing price sensitivity, the trade package has also contributed towards an increase in patriotic consumer behavior influencing consumer decision-making. A trend that has been further exacerbated by the political rhetoric surrounding the tariffs that characterize global commerce in increasingly adversarial terms.

This rising economic nationalism engendered by the tariffs have thrust brands into the center of a heated geopolitical debate, where neutrality isn’t an option and every response carries risk. In this volatile environment, some of the key risks faced by comms teams include:

| Heightened consumer scrutiny is reshaping buying behavior and stakeholder expectations with tariffs seen as loyalty signals. Consumers, influencers, and even policymakers now scrutinize where brands stand. Issues that were once considered operational details are now capable of sparking reputational backlash that can erode brand equity overnight. | |

| Tighter ESG and supply chain scrutiny are increasing both reputational exposure and compliance requirements. Regulators and watchdogs demand transparency across sourcing, labor, and emissions — and public stakeholders notice when brands fall short. | |

|

Online sentiment moves faster than regulation. The virality offered by social platforms has meant that even routine brand announcements over price adjustments or supply chain shifts can provide fodder for mis-and disinformation and employee criticism or coordinated online campaigns that seek to erode brand reputation before a global audience of consumers. |

Communications teams are being forced into making high-stakes calls on customer communication and policy response in this adversarial economic environment, often with little time to test messaging or gauge potential backlash.

These decisions carry long-term implications for a brand’s reputation, operations and financial performance. A poorly crafted statement about sourcing changes can spark boycott campaigns. Silence can be interpreted as complicity while over-explanation runs the risk of making a brand appear defensive or tone-deaf to consumer concerns.

What makes today’s trade backlash different isn’t just how fast it moves. It’s how these narratives easily cross borders. A pricing change in one market can trigger backlash in another, especially when posts are translated, reinterpreted, and shared across platforms. Before enforcement even starts, brands can be dealing with compounding perception issues in five languages, on ten channels, with no single point of control.

How to spot early signs of trade risk backlash

Fallout doesn’t require bad intent, just a mismatch between brand actions and stakeholder or consumer perception. Reputational fallout can move faster than policy enforcement, especially when brands fail to catch early signs of brand risk from tariffs in digital discourse.

|

Brand Action |

How It’s Interpreted | Narrative Risk Example |

|

Price increase |

“Greed,” “profiteering,” “anti-consumer” |

#PriceGouging trends after 25% console hike |

|

Sourcing shift |

“Political loyalty,” “abandoning national jobs” |

Viral social media threads link brands to trade blocs |

|

Public silence |

“Evasion,” “complicity,” “values misalignment” |

Influencers demand statements; brands ghosted |

|

National affiliation |

“Unpatriotic,” “foreign loyalist” |

Brands operating in global markets are questioned over their “national affiliation”. |

|

Messaging misfire |

“Defensive,” “tone-deaf,” “performative” |

ESG response gets reframed as greenwashing |

In Resolver’s “Beyond the Noise” ebook, 42% of major brand crises tied to trade and sourcing issues were visible in public sentiment data before any internal alerts were triggered. The new reality: narrative momentum now begins before official statements are made with popular influencers, watchdogs and anonymous accounts shaping the online discourse. Public backlash can begin on small forums and alt-tech platforms before going viral across mainstream social platforms and media.

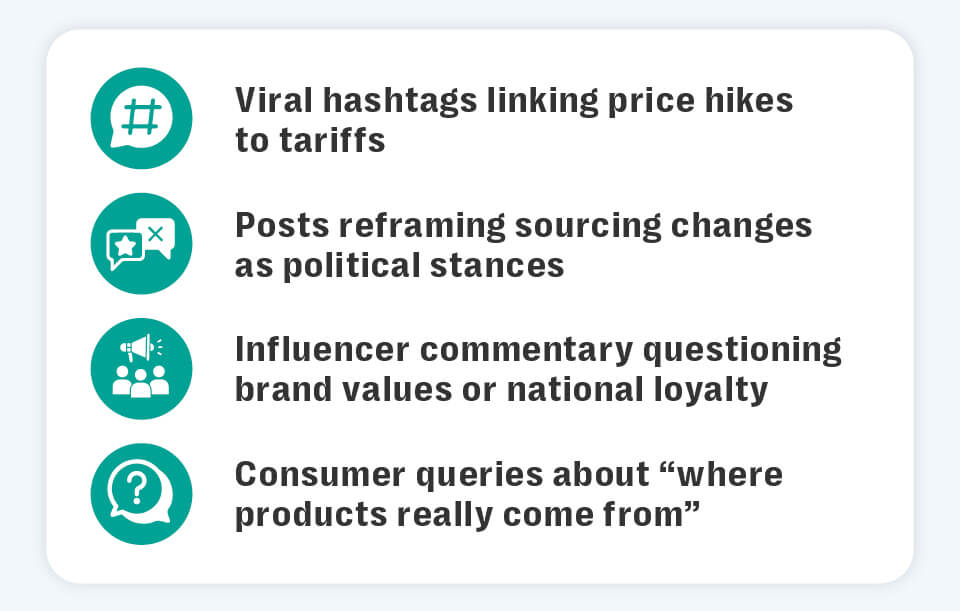

Common red flags of brand risk from tariffs

For communications professionals, trade-related risks often surface first in social sentiment rather than financial data. They appear as viral social media posts, coordinated hashtag campaigns, influencer commentary, or consumer questions that catch brands off-guard. In this environment, communications teams need robust systems for monitoring and addressing trade-related reputational risks before they escalate:

Why these signals matter: behind each one is a predictable pattern. Price hikes become stories about “corporate greed”. Sourcing shifts are reframed as political. Silence is interpreted as evasive. Brands that don’t catch these early often lose the narrative before they can respond.

Many of these signals arise outside traditional English-language platforms, making multilingual monitoring and regional context critical.

Tools to monitor brand risk from tariffs in 2025

Traditional media monitoring tools track mentions and spikes, but in today’s trade environment, volume alone doesn’t equal risk. Brands need visibility into how they’re being framed, where sentiment is shifting, and why it matters.

Must-have features in brand risk monitoring:

- Narrative tracking: Not just sentiment, but the themes shaping perception (e.g., “price gouging,” “foreign loyalty,” “greenwashing”).

- Regional intelligence: Monitor emerging backlash in priority markets, including non-English platforms where early signals often appear.

- Business-relevant alerts: Prioritize what impacts reputation, valuation, or stakeholder trust — not just what’s trending.

- Routing risk signals to teams: Ensure insights reach the right team fast legal, comms, ESG, ops. For advanced capabilities, explore Resolver’s compliance risk monitoring tools.

Many brands now rely on simple vanity metrics and data dashboards that flag high-volume risks, in contrast, those that employ analyst-validated monitoring platforms are capable of detecting and interpreting early signs of backlash.

These risk signals often surface before public sentiment locks in and becomes harder to shift. For more on recent trade actions and strategic planning, explore Kroll’s Tariffs Hub: Stay Ahead of Tariff Changes.

How comms, legal & ESG teams can respond to tariff risk

| Define roles and escalation protocols. Know who responds to what. Is it legal, comms, or ESG? Define escalation triggers and have joint review protocols in place for high-risk messaging. | |

| Develop build messaging aligned with brand values. Consumers now expect brands to take positions on sourcing ethics and global responsibility. Create comms guardrails before you’re forced to take a public stand. | |

| Monitor market-by-market trade narrative risk. One tariff policy may trigger sympathy in one market and outrage in another. Resolver’s Online Risk Intelligence platform provides localized context so you’re not caught off-guard. | |

| Anticipate narrative reframing scenarios. Even apolitical statements such as announcing a new supplier can be framed as political. Prepare for reinterpretation across different platforms and audiences. |

How contextual online risk intelligence protects brand reputation

Research from Kroll, Resolver’s parent company, shows that rapid shifts in public sentiment, particularly those tied to tariffs or regulatory enforcement can disrupt more than messaging. Sentiment downturns linked to pricing backlash can impact stock performance.

For public companies, this may lead to valuation reevaluations and trigger scrutiny in M&A talks and goodwill assessments. Brands caught unaware may face reputational damage, legal exposure, or ESG disclosure fallout. Resolver’s fully managed Social Listening and Online Risk Intelligence service helps comms, ESG, and legal teams identify which signals actually matter to your brand and offer issue-specific alerts and regional insights that support faster decisions in volatile trade environments.

Resolver’s fully managed Social Listening and Online Risk Intelligence service helps comms, ESG, and legal teams identify which signals actually matter to your brand and offer issue-specific alerts and regional insights that support faster decisions in volatile trade environments.

Looking ahead: The future of brand risk from global trade policy

For comms and PR professionals, the intersection of geopolitical pressure, economic grievance and online discourse has become the new battlefield for brand reputation. As trade tensions evolve, companies should expect continued volatility in how pricing, sourcing, and brand identity are perceived and contested across public channels.

Tariff policy is now closely linked to reputational risk. For many organizations, understanding how 2025 trade policy impacts stakeholder sentiment is essential to mitigating brand risk from tariffs.

In 2025, each supply chain shift, pricing decision, or public statement may be interpreted through a broader social or regulatory lens. Brands that delay response may find it harder to shape the conversation. Those that monitor smarter, move faster, and message with intention will be best positioned to maintain customer trust and preserve long-term value.