Too many teams build a business continuity plan (BCP) to satisfy regulators, not because they believe the plan will work. It gets written, stored, and maybe reviewed once a year. Testing is rare, and when it does happen, the gaps are obvious.

That approach used to be enough. It’s not anymore.

Regulators like OSFI, PRA, the SEC, and others are shifting their focus. Instead of just checking if your plan exists, they want to see if it works. That shift comes with tougher questions: If your call center is down for a full day, what happens next? Who takes the lead? What steps do they follow? Have those steps ever been tested?

A credible plan doesn’t stop at listing steps. It explains why each step exists, who owns it, how it ties to impact, and sits inside a program that’s tested and kept up to date.

If your plan can’t show that level of thinking, it won’t hold up. Not when regulators review it, and not when your business actually needs it. Here are five signs your BCP wouldn’t stand up.

Sign #1: Your plan skips the BIA and continuity strategy

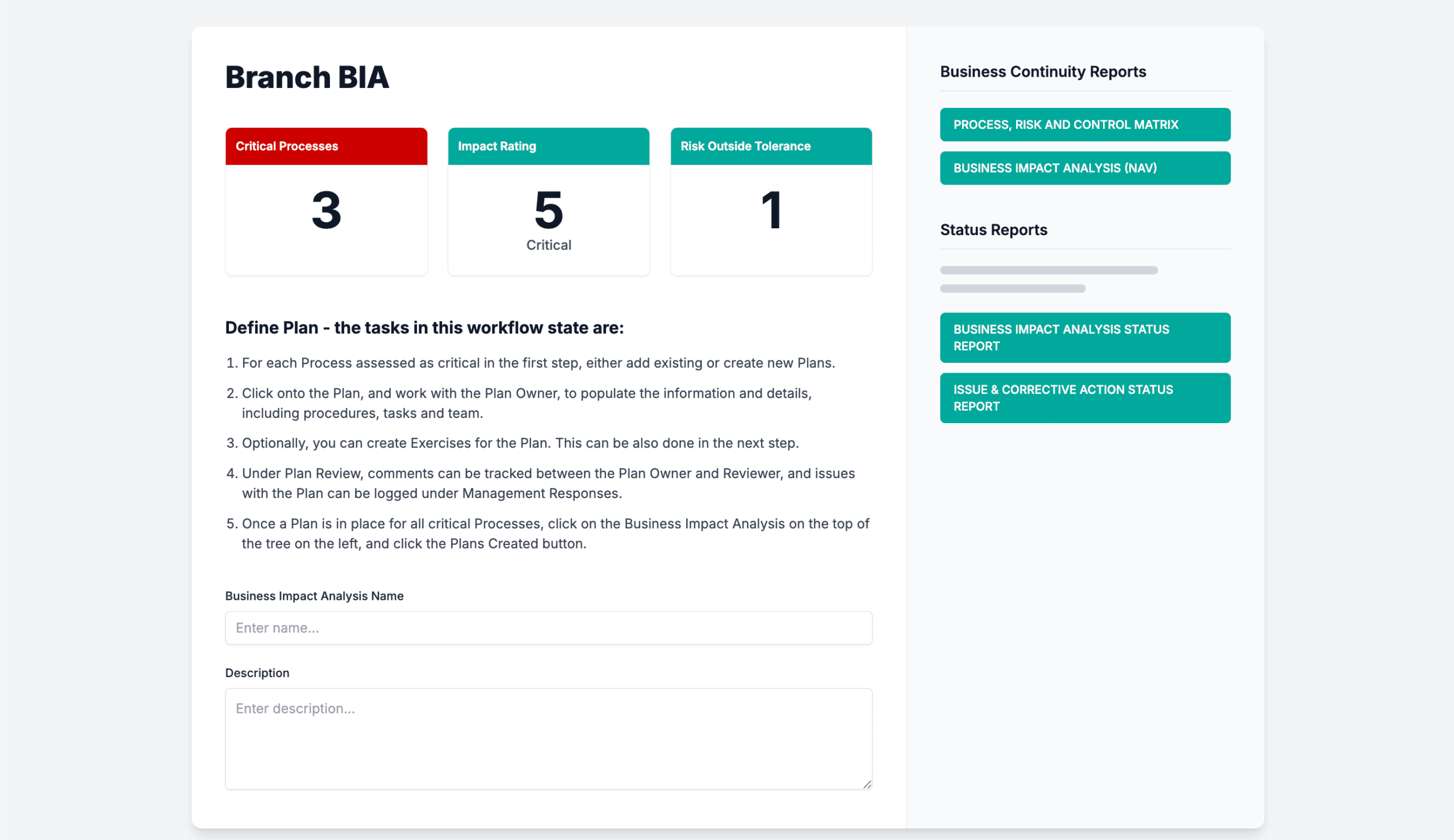

If you don’t start with a Business Impact Analysis (BIA), your business continuity plan has no real direction. You’re filling in blanks without knowing what matters.

The BIA comes first. It identifies which business processes matter most, how long each one can be down, and what the financial, regulatory, or customer-facing impacts would be. It also defines recovery time objectives (RTO), recovery point objectives (RPO), and maximum tolerable downtime (MTD), and maps the risks that could take those processes offline.

Next is the continuity strategy. That’s where you decide how to respond if a key process fails. What systems, people, locations, or vendors does it rely on? What happens if one of those goes down?

Only after those steps do you build the BCP itself, reflecting both the impact and the strategy behind each decision. If it doesn’t clearly show which BIAs it’s based on, or which risks and recovery paths it’s addressing, reviewers won’t be able to follow the logic.

Under scrutiny, regulators will ask: Why this process? Why this order? Why this vendor? If your BCP can’t explain the reasoning behind those choices, it won’t hold.

Sign #2: The plan lacks structure: no procedures, tasks, or teams

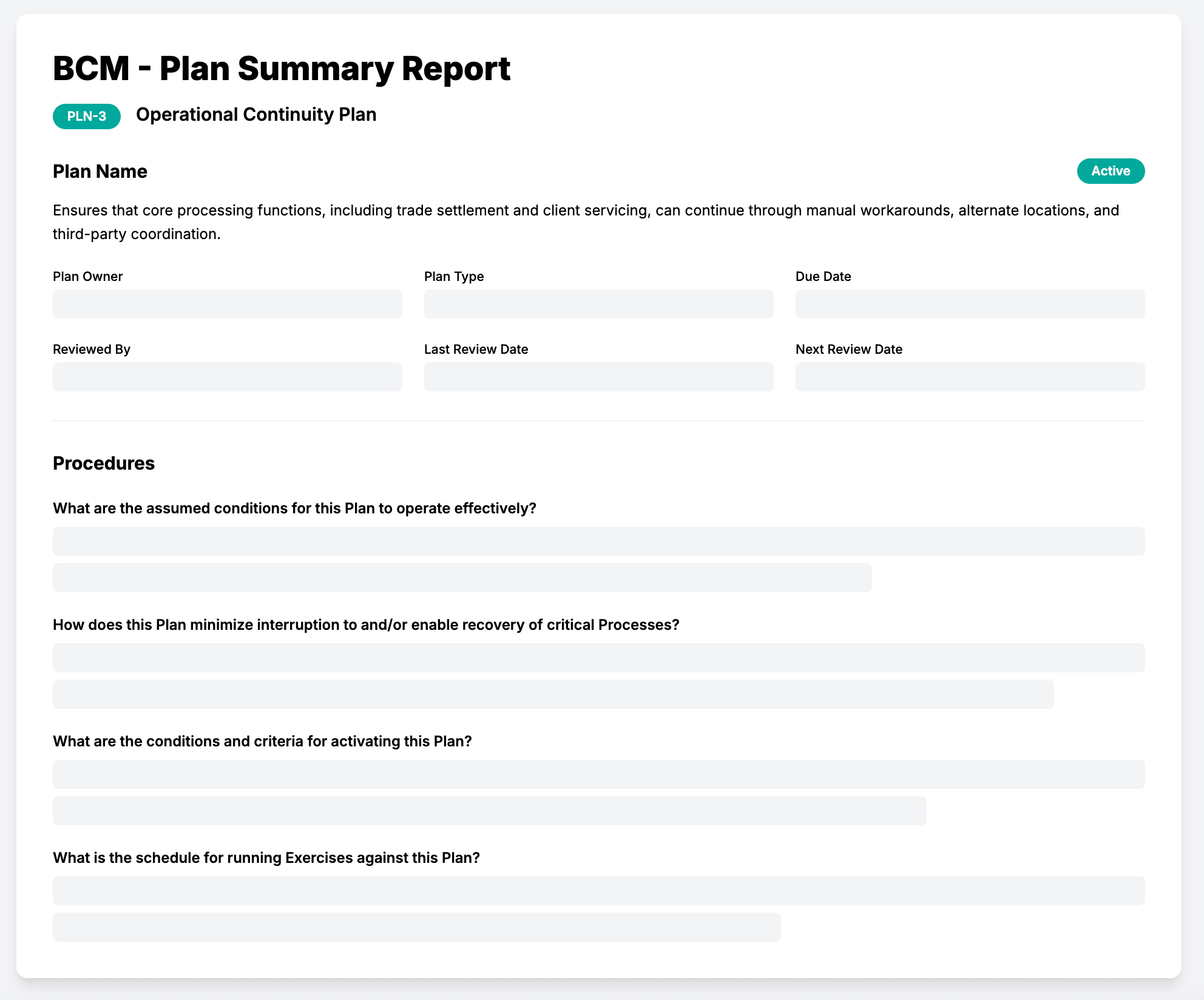

When a business continuity plan gets tested by an exercise or a real disruption, clarity matters. Teams need to know what the plan covers, who’s involved, and what steps to take. If the document is vague or hard to follow, response slows down.

Weak plans usually fall into one of two traps. They either read like broad policies with no actionable detail, or they list technical steps without any context. Both lead to the same problem: confusion when timing matters most.

A solid BCP should do one thing well: Make it easy for people to act. That starts by organizing the information in a way people can actually use by focusing on three elements:

| Procedures: | Provide a high-level view explaining what the plan covers, why it exists, how it’s kept up to date, and who owns it. Set the scope and explain how to use the BCP. Without it, teams are left guessing when to activate the plan or which scenarios it applies to. | |

|

Tasks: |

List step-by-step actions to follow when a disruption happens. They should already be determined, not figured out on the spot. Tasks show how to recover key processes and get continuity strategies moving. If the steps are missing, response slows and decisions pile up when time’s already tight. | |

| Team: | Define who’s responsible for each task and assign them to people, not just roles or departments. Without clear ownership, things slip through the cracks or get duplicated. Everyone needs to know who’s doing what, and when. |

If your plan doesn’t include these three parts, or buries them in a sea of general statements, it’s not ready.

Discover Resolver's solutions.

Sign #3: The plan is treated as a static document

A business continuity plan that’s left untouched isn’t a plan, it’s a risk. Teams change. Systems get replaced. Vendors shift. If the BCP doesn’t reflect those changes, it quickly becomes outdated.

Regulators notice that. They’ll ask who’s on the recovery team. Are those people still with the company? Do the listed systems still exist? If not, the plan sends the wrong message: continuity isn’t being maintained. Plans written months or years ago often direct teams to use tools that no longer exist or contact people who’ve moved on. That damages credibility.

And if the BCP hasn’t been tested, there’s no way to know if it works. Exercises aren’t just formalities. They show where the plan breaks, and give you the chance to fix it before something goes wrong. Without regular updates and testing, the plan stops reflecting how the business actually operates. And when it’s needed, it won’t hold up.

Sign #4: The plan centers on processes, not people

A BCP can cover every system and workflow. But if it overlooks the people involved, it’s incomplete. Recovery goes beyond restoring operations, it manages impact on employees, customers, and third parties.

Plans often focus on getting systems back online without addressing communication. For example, payroll might be restored in two hours, but if no one tells employees what happened, trust is already lost. The same applies to vendors. If they’re left in the dark, they may delay their own response or escalate the issue.

Planning for people means thinking beyond internal steps. Who needs to be informed? When? How? And it means thinking about the people responding. Do they know their roles? Can they access the plan? Are they equipped to act during off-hours or from a remote location?

If those gaps aren’t addressed in advance, they show up during a disruption, when there’s no time to fix them.

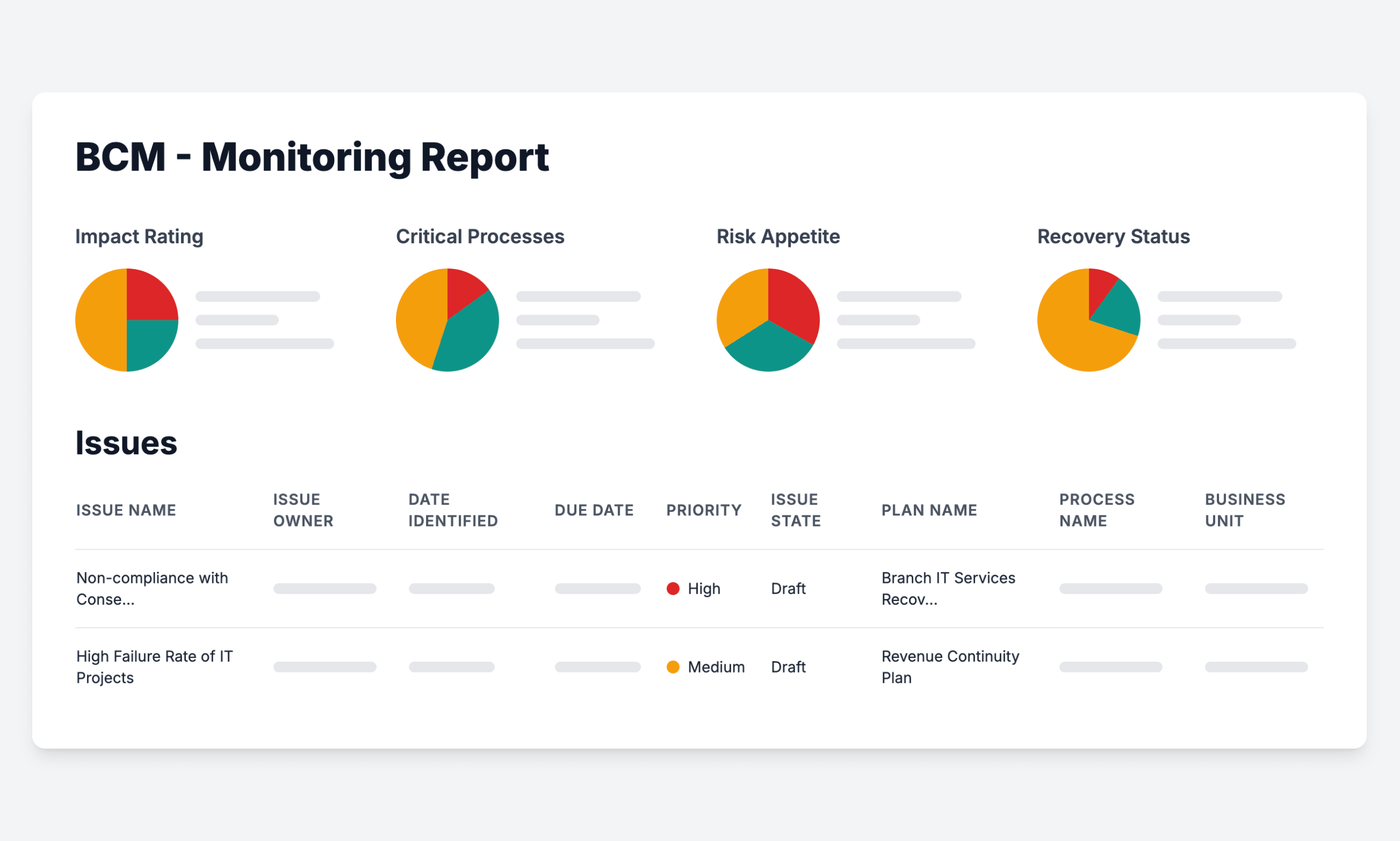

Sign #5: Your plan is isolated from the broader GRC program

If the continuity team works in a silo, the plan won’t reflect how the business actually runs. Recovery decisions need input from risk, compliance, IT, and vendor management. Without that, the plan misses key context. That’s where you start to see recovery timelines that conflict with regulations, tasks that ignore control failures, or strategies that go against the company’s risk appetite.

Take this example: your business continuity plan outlines a recovery timeline for payroll after a system outage. But compliance didn’t confirm what’s required in each region. In some cases, labor laws set strict timelines for when employees must be paid, even during a disruption. Now the plan risks falling out of step with legal obligations, simply because that input wasn’t part of the process.

That’s not a planning mistake, it’s a coordination failure. Regulators don’t just want to see a plan. They want to see how it connects to current risk data, policies, and team responsibilities. If those links aren’t visible, the plan doesn’t just look outdated, it looks disconnected and unaccountable.

Fix your business continuity plan gaps with Resolver

If your business continuity plan shows any of these signs, it won’t hold up when regulators start asking questions. Documentation alone isn’t enough. They want to see how the BCP was built, what risks it addresses, and whether it reflects how the business actually operates. If the plan’s disconnected, outdated, or missing that foundation, those gaps won’t stay hidden. They’ll come out under review, during real disruptions.

Resolver’s Business Continuity Management software helps close those gaps. It gives you a structure for building plans that reflect your real-world operations, starting with BIAs, recovery objectives, and continuity strategies. Every plan includes documented tasks, clear owners, and direct links to the risk and compliance data regulators expect to see.

The result? A business continuity program that holds up during regulatory reviews, when your teams are under pressure to recover fast and get operations back on track.

Book a demo today to see how Resolver helps you build a BCP your teams trust, and regulators recognize.