Financial influencers or “finfluencers” play an outsized role in shaping how financial information is disseminated and consumed online. Particularly effective with younger demographics like Millennial and Gen Z audiences, finfluencers offer bite-sized financial advice that can make investing more accessible and create new marketing opportunities for savvy financial institutions.

However, the unregulated nature of this advice and the sometimes lower financial literacy among target audiences has also resulted in the proliferation of misleading, oversimplified, and potentially dangerous financial recommendations.

In short, finfluencers represent both an opportunity and a threat. Tapping into new channels to engage younger customers may be enticing but the regulatory risks have to be carefully considered.

The staggering reach of finfluencers

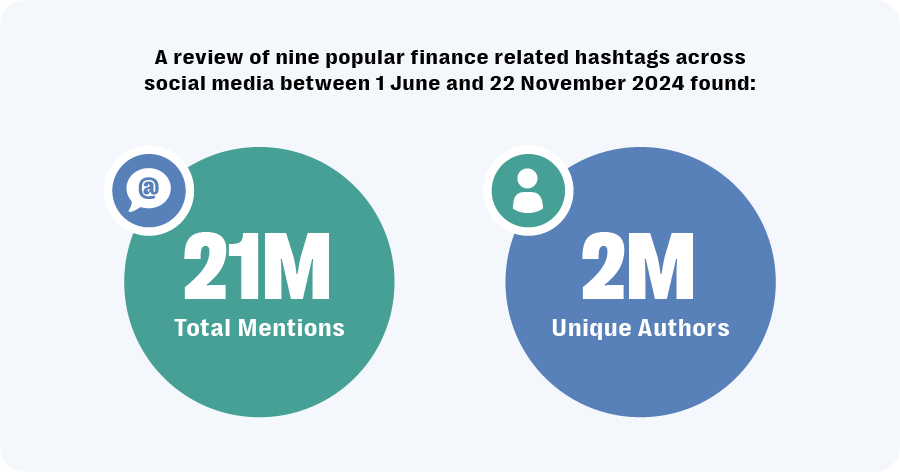

The popularity of financial content on social media is staggering, a Resolver review of nine popular finance-related hashtags across social platforms between June and November 2024 found they received over 21 million mentions from 2 million unique authors. Hashtags commonly employed by finfluencers such as #financialfreedom, #investing, #crypto gained tens of millions of views from users on these platforms over the examined time frame.

Examples of popular finfluencer content available across mainstream platforms.

A review of nine popular finance related hashtags across social media between 1 June and 22 November 2025 found that they received over 21 Million mentions across social platforms over the examined time frame.

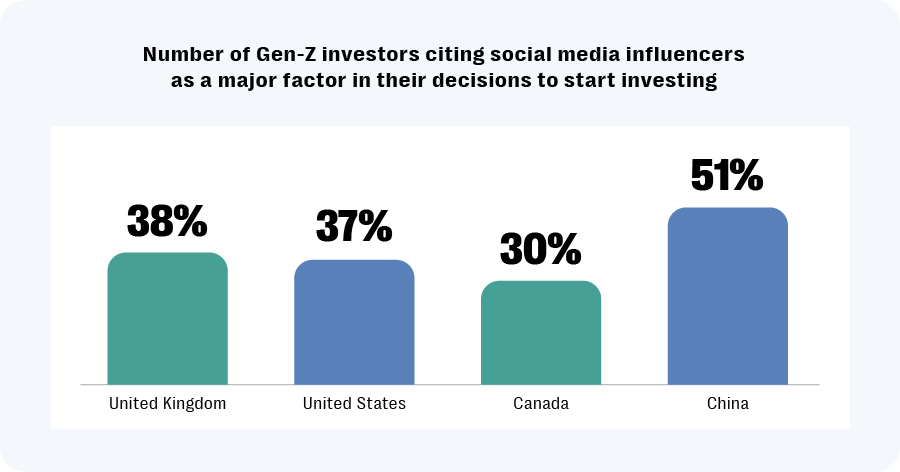

The online reach of finfluencers also carries serious real-world implications when considering their ability to influence the decisions of younger investors. According to data published by CFA Institute research and policy center in January 2024:

- 38% of Gen-Z investors in the UK, 37% in the US, 30% in Canada and 51% in China cite social media influencers as a major factor in their decisions to start investing.

- Investors under the age of 34 were likeliest to say they trust social media as a source of investment information.

- Gen-Z investors displayed a greater risk appetite and lower levels of financial literacy making them particularly vulnerable to fraudulent or misleading financial advice.

The proliferation of unregulated financial advice on social media has also created new financial, regulatory and operational risks. Analysis drawn from a survey conducted by Barclays in October 2024 found that “influencer misinformation” represents a significant threat. The study found that 52% of investment scams take place on social media with 39% of respondents aged 18-24 years old saying they felt “unsafe online due to the prevalence of investment scams”.

How are regulators reacting?

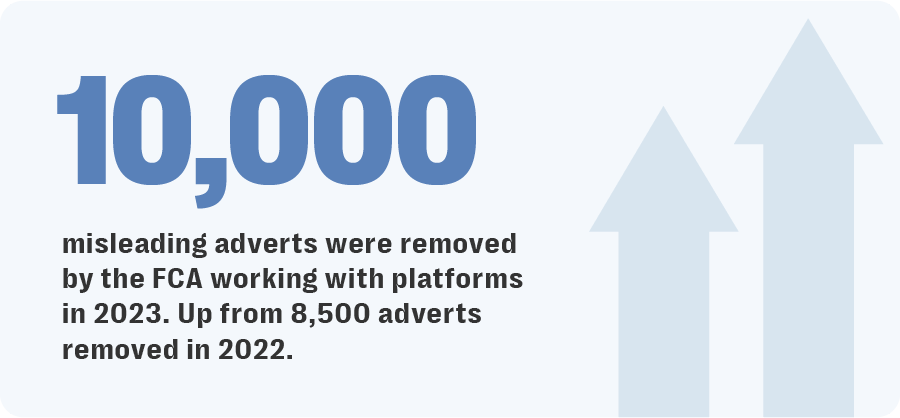

Regulators are ramping up efforts to crack down on misleading online financial promotions. In March 2024, the Financial Conduct Authority (FCA), a regulatory body in the UK, issued a warning to finfluencers to ensure that adverts displayed across their social media channels were “fair, clear and not misleading” and carried appropriate disclaimers so that consumers could make well-informed financial decisions.

The FCA also published guidelines outlining compliance requirements for financial promotions on social media and emphasized that brands working with finfluencers were “on the hook for all their promotions” announcing that it had worked with platforms to remove over 10,000 misleading adverts, up from 8,500 in 2022.

Months later, in May, the FCA brought legal charges against nine individuals in relation to an unauthorized foreign exchange trading scheme and issuing unauthorized financial information across social media platforms.

The UK regulators approach echoes the positions outlined in an earlier report published by the International Organization of Security Commissions that noted the lack of transparency around the associated risks of the products and financial advice provided finfluencers and recommended regulators to “remind firms they are responsible for the online comms of finfluencers”.

As financial regulators continue to place greater emphasis on firms to monitor finfluencer content for compliance, banks can face financial penalties if associated finfluencers fall foul of the evolving advertising and disclosure requirements around sponsored content and unlicensed investment advice.

Consequently, banks and financial institutions working with finfluencers must navigate a complex landscape of advertising standards, disclosure requirements and evolving consumer protection laws, with the risks associated with non-compliance growing more acute by the day.

What are the regulatory harms caused by finfluencers?

The pursuit of viral content can exert significant pressure on individual finfluencers on how to stand out in the highly competitive digital influencer economy. These pressures can incentivize some finfluencers to indulge in hyperbole when promoting investment returns, downplay the risks of certain investments and forego disclosures of affiliate partnerships with particular brands or financial products.

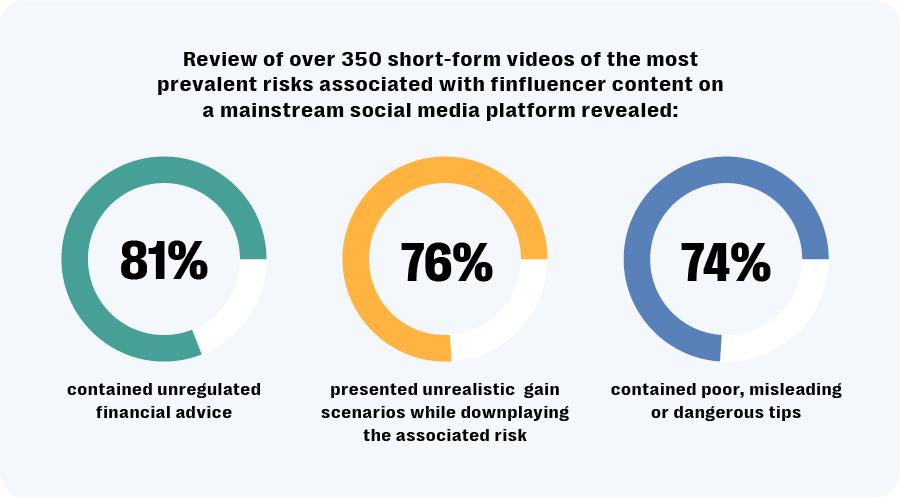

To determine the most prevalent risks associated with finfluencer content on social media, a team of financial experts at MoneySuperMarket reviewed over 350 short-form videos on a mainstream platform between February and March 2024. This investigation revealed:

- A majority of videos (81%) contained unregulated financial advice, 74% contained poor, misleading or dangerous tips and 76% presented unrealistic gain scenarios while downplaying the associated risk.

- Investment-related content was the most egregious category for misleading or poor advice with 90% of videos across this category assessed to provide unregulated advice, of which 62% promoted a particular product or service.

- More broadly, 41% of the videos promoted unhealthy “money mindsets” that touted get-rich-quick schemes over prudent financial habits.

Banks and financial institutions face increasing financial, reputational and regulatory risks when associating with finfluencers who provide unlicensed financial advice or promote fraudulent schemes. Customers who suffer financial harm after following advice from such finfluencers may hold the institution responsible leading to an erosion of brand reputation and customer trust.

As regulatory bodies continue to reign in the finfluencer industry by holding firms accountable for the content shared by affiliated finfluencers, banks or financial institutions can face substantial fines and sanctions if they fail to adequately monitor and control such affiliated content.

How can Resolver protect your online risk and ensure compliance?

To mitigate these multifaceted risks, banks need to invest in proactive monitoring and rapid response capabilities to identify and counteract problematic finfluencer content before it snowballs. Relying solely on retroactive regulatory enforcement or after-the-fact damage control will be insufficient in the fast-paced social media environment.

For banks and financial institutions, Resolver’s leading social listening and online risk intelligence solutions combine advanced data collection and risk detection capabilities with expert human intelligence analysis to catch and mitigate finfluencer risks early.

From early-warning alerts providing a succinct description of a risk within 30 mins of being published on-platform to executive-ready situation reports providing a fuller picture of a trending risk or violation including metrics around data, reach, impacted platforms, sources, geo-analysis, key detractors and drivers of a harmful trend, we ensure our clients are always the first to know and first to act.