Every whistleblower report presents both a compliance opportunity and a legal risk. When handled correctly, these reports help companies uncover fraud, bribery, harassment, and policy violations before they escalate. But when even a single whistleblower complaint is mishandled, your organization could face multi-million-dollar fines, regulatory scrutiny, and lasting reputational damage.

With global whistleblower protections expanding, corporate compliance teams must ensure internal investigations are efficient, transparent, and legally defensible. Companies that fail to properly track, triage, and document investigations of whistleblower cases risk serious legal and financial consequences:

- A record-breaking $279 million SEC whistleblower payout in 2023 signalled a crackdown on corporate misconduct.

- The DOJ’s 2024 Corporate Whistleblower Awards Program enforces a 120-Day-Rule. Companies must demonstrate internal action on misconduct reports within 120 days — or face external escalation and penalties.

- The EU Whistleblower Directive, now fully enforceable since 2024, mandates audit-ready documentation and anti-retaliation protections, with severe fines for non-compliance.

Yet, many organizations still rely on outdated, fragmented systems that delay investigations, expose compliance gaps, and increase audit failure risk.

A weak whistleblower program isn’t just a compliance issue — it’s a serious business risk. Leading organizations are moving beyond time-consuming, analog workflows and adopting centralized whistleblower case management solutions to streamline investigations, improve substantiation rates, and ensure audit-ready reporting.

Below, we break down the seven biggest whistleblower case management risks — and the best ways to mitigate them before they turn into costly compliance failures.

Risk #1: Poor initial whistleblower report intake

A whistleblower’s initial report sets the stage for an investigation. If your intake process is scattered across emails, file drives, or manual logs, you risk:

- Missing critical case details, leading to regulatory non-compliance.

- Audit failures due to inconsistent whistleblower report tracking.

- Legal exposure from retaliation claims if case handling isn’t properly secured and recorded.

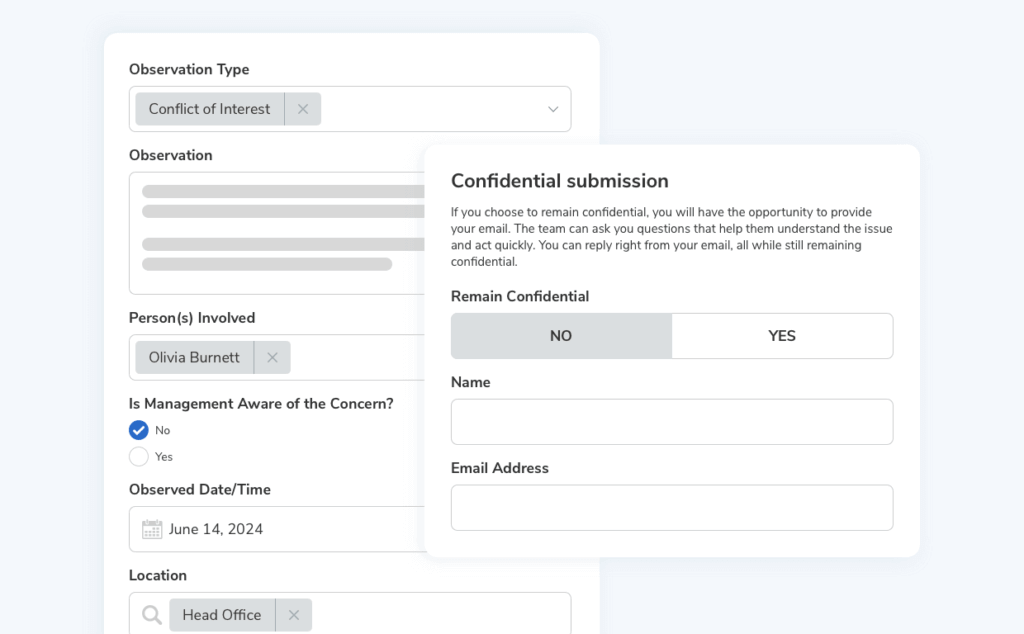

Regulations like the EU Whistleblower Directive require organizations to provide secure, standardized intake channels to ensure detailed, actionable reports. Employees who lack trust in the system or fear retaliation are more likely to submit vague reports — or not report at all, increasing the risk of external disclosures and regulatory action.

How to improve whistleblower report quality:

- Standardize intake forms to capture critical details upfront.

- Ensure reports are compliant with global reporting mandates (DOJ 120-Day Rule, EU Whistleblower Directive).

- Enable, secure multi-channel reporting (hotlines, portals, SMS) to increase accessibility, while protecting anonymity and trust.

- Guide whistleblowers through submissions with prompts to prevent missing information.

- Train investigative teams on whistleblower protection requirements to encourage detailed, accurate, and compliant reporting and case handling.

Organizations that fail to modernize whistleblower intake processes expose themselves to increased compliance risk, legal liability, and reputational damage. A structured, secure reporting system not only reduces the risk of external disclosures but also strengthens internal trust and demonstrates regulatory accountability.

Risk #2: Delayed and inconsistent triage

You can’t investigate what you don’t see. If whistleblower reports sit in inboxes, get lost in fragmented systems, or aren’t reviewed in time, your organization is already exposed. You need a systematic way to review, prioritize, and — when relevant — escalate misconduct complaints quickly. Slow or inconsistent triage creates:

- Regulatory scrutiny if reports aren’t reviewed and escalated in time.

- Legal exposure from delayed investigations that allow misconduct to continue.

- Audit failures — without clear documentation, you can’t prove compliance in case reviews.

If your team doesn’t have a structured, centralized triage process, critical reports will slip through the cracks, putting your organization at risk of fines, lawsuits, and reputational damage.

How to ensure timely, compliant triage of whistleblower complaints

- Automate report intake and categorization to flag high-risk cases immediately.

- Set and enforce strict SLAs to track response times and prevent bottlenecks.

- Implement structured workflows for investigator handoffs so every case is reviewed and managed consistently.

- Centralize case tracking to eliminate audit failures and visibility gaps.

- Use AI-driven risk scoring to prioritize and escalate critical cases without tedious admin delays.

- Assign dedicated personnel to effectively oversee and enforce triage timelines. A modern whistleblowing and case management system can provide reporting and analytics features to help.

A delayed response is a compliance failure. Regulators don’t accept excuses for missing or mishandling reports. If your triage process isn’t fast, structured, and trackable, it’s time to fix it — before you’re forced to.

Risk #3: Low substantiation rates

If whistleblower reports are routinely dismissed without a clear and defensible process, regulators won’t see it as a sign of a well-run compliance program — they’ll see it as a failure to investigate properly.

Consistently low substantiation rates indicate gaps in your investigative oversight. If your team isn’t conducting thorough, unbiased reviews of whistleblower reports, your organization risks:

- Regulators perceiving low substantiation rates as signs of investigative bias or procedural gaps.

- Legal exposure as dismissed-but-valid reports can signal unresolved systemic issues, leading to lawsuits, enforcement actions, or class-action claims.

- Missed opportunities to identify patterns of misconduct, allowing hidden risks to escalate.

Regulators expect a fair, transparent process for reviewing and substantiating whistleblower reports. If your investigations lack credibility, expect deeper regulatory scrutiny, legal challenges, and reputational damage.

How to increase substantiation rates:

- Enforce standardized investigative protocols to ensure every report is thoroughly reviewed.

- Ensure investigators follow regulation-aligned standards using structured workflows that eliminate bias.

- Centralize case tracking in a secure platform to maintain a clear audit trail of investigative decisions.

- Audit dismissed (unsubstantiated) cases to identify patterns, eliminate bias, and improve investigative workflows.

- Proactively track trends in case dismissals and investigative outcomes.

- Regularly review case closure rates to maintain consistent, fair substantiation rates aligned with regulatory expectations.

A high number of dismissed reports doesn’t prove compliance — it raises suspicion. Strengthening your ethics and compliance investigative oversight and review processes reduces legal risk and ensures whistleblower concerns are handled with integrity.

Don’t miss a step: Download your free Workplace Investigation Readiness Checklist

Risk #4: Poor data visibility and reporting gaps

When regulators ask for documentation, will your system hold up — or expose gaps?

Regulators expect precision in how you track, analyze, and act on whistleblower reports with precision. Yet many ethics and compliance teams still rely on fragmented, analog systems that make accurate reporting to regulatory bodies impossible.

Without centralized, structured records, your organization risks:

- Regulatory penalties for missing or incomplete audit trails.

- Increased legal exposure from failing to demonstrate thorough, defensible investigative processes during audits.

- Unaddressed systemic risks, as poor visibility prevents proactive identification of misconduct trends.

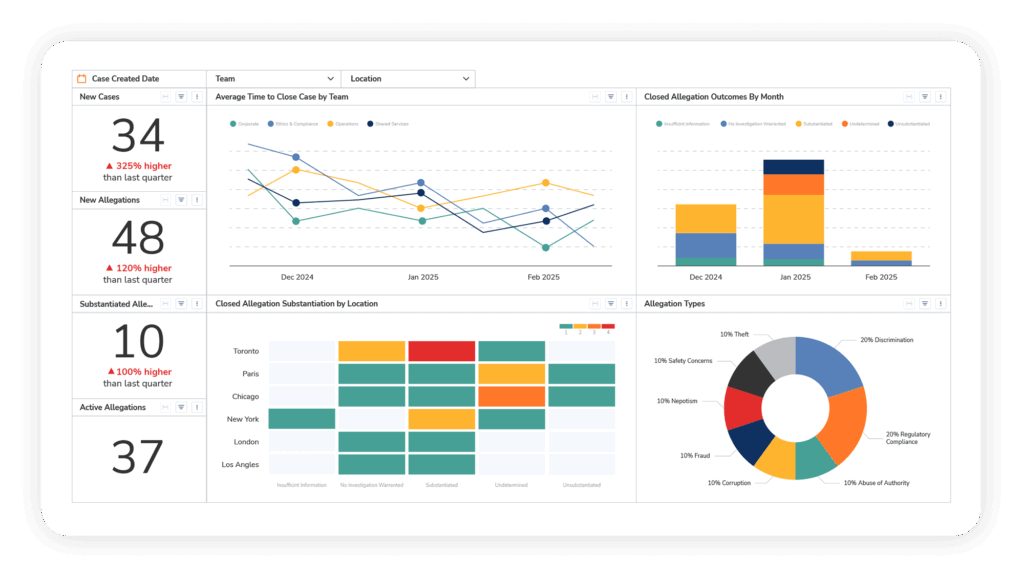

Leadership needs real-time visibility to assess program effectiveness and track trends. If your team can’t quickly access accurate case data, regulators will see it as a failure of oversight.

How to improve data visibility and compliance reporting:

- Centralize whistleblower case management to securely track reports from intake through resolution, ensuring all data is audit-ready.

- Deploy real-time dashboards to instantly visualize trends, compliance gaps, and case progression and keep leadership informed.

- Standardize documentation processes to consistently capture all required details and meet regulatory audit standards.

- Automate audit trails and report generation to maintain defensible records that withstand regulatory scrutiny.

- Implement role-based access controls ensuring stakeholders securely access only information relevant to their responsibilities.

- Integrate compliance data across systems (like HRIS, BI) to reduce redundancy and ensure a single source of truth for whistleblower investigations.

A modern whistleblowing and case management system ensures you’re always prepared — not scrambling when regulators come calling. Fix your visibility gaps now, before they become your biggest liability.

Risk #5: Missed early warning signs

Missed trends can allow risks to spread unchecked. Effective whistleblower case management means recognizing early warning signs to prevent issues before they escalate into enterprise-wide compliance breaches. If your organization lacks early detection capabilities, you risk:

- Allowing isolated misconduct to evolve into widespread compliance failures.

- Increased regulatory scrutiny and penalties for not proactively identifying risks.

- Multi-million-dollar fines and severe reputational damage due to late responses to whistleblower reports. (Like recent SEC enforcement cases totaling over $1.1 billion and the DOJ’s $1M+ per violation fines.)

Regulators don’t just assess how you handle misconduct — they scrutinize how quickly you detect and act on it. If you’re only reacting after violations surface, you’re already behind.

How to strengthen early detection and compliance oversight:

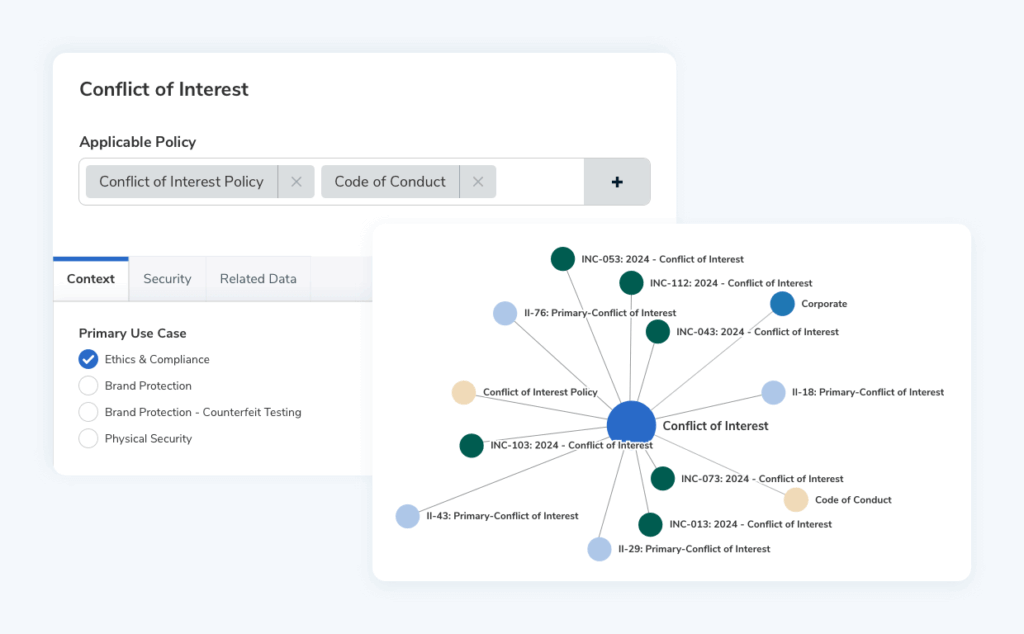

- Leverage analytics to spot recurring themes, locations, or individuals involved in reports.

- Use real-time dashboards to surface risk trends, anomalies, and emerging compliance issues before they escalate.

- Conduct regular risk assessments and policy reviews informed by whistleblower report data to identify systemic vulnerabilities.

- Integrate whistleblower case data with other internal systems (HR, finance, security) for a complete risk picture.

- Deliver executive reports to senior leadership to ensure proactive risk mitigation.

- Ensure investigative teams follow structured workflows to detect and address patterns of misconduct.

When it comes to whistleblowing cases, regulators expect organizations to be proactive, not reactive. If your team isn’t spotting misconduct patterns early, regulators might assume you’re ignoring them. Fix your detection strategy now — before they force you to.

Risk #6: Fragmented evidence and disconnected investigation workflows

Effective whistleblower investigations rely on robust evidence collection and coordinated workflows to keep evidence and documentation secure. If your corporate investigation processes are fragmented across multiple tools or analog systems, you risk:

- Losing critical evidence, weakening legal defensibility and increasing liability.

- Inefficient workflows leading to delays, regulatory penalties, and employee distrust.

- Increased likelihood of audit failures due to inconsistent documentation and missing case records.

Regulators don’t just look at whether you investigated — they scrutinize how well you documented every step. If your team can’t prove how evidence was collected, stored, and reviewed, your investigative findings won’t hold up under scrutiny.

How to streamline investigative workflows and evidence handling:

- Centralize evidence collection and investigative tasks in a unified whistleblowing and case management platform to ensure security and consistency.

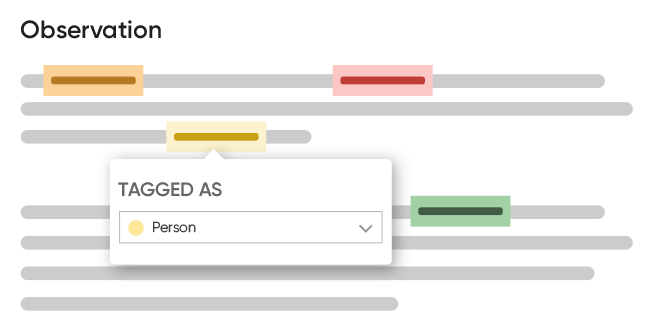

- Enable structured evidence tagging and secure storage to ensure legal defensibility and easy retrieval during audits.

- Implement structured investigative workflows to ensure every investigation follows a repeatable, reliable, and defensible process.

- Facilitate collaboration through secure, role-based workspaces that enable multiple investigators to seamlessly coordinate efforts while maintaining confidentiality.

- Use real-time dashboards, notifications, and case tracking features to monitor investigative progress to prevent backlogs.

If evidence is scattered or investigations stall, regulators will assume your organization lacks investigative control. A centralized, structured approach ensures investigations are efficient, defensible, and audit-ready.

Risk #7: Failure to foster a speak-up culture

If employees don’t trust your whistleblower program, they won’t use it. A culture of silence doesn’t mean misconduct isn’t happening — it means you’re not hearing about it until it’s too late.

When employees fear retaliation or believe reporting won’t lead to action, your organization risks:

- Fewer internal reports, increasing the likelihood of external whistleblowing to regulators, media, or courts.

- Unchecked misconduct, as fear of retaliation discourages early intervention.

- Reputational damage, as issues that could have been resolved internally escalate publicly.

Regulators expect more than just a reporting mechanism — they want to see a workplace where employees feel safe speaking up without fear of retaliation. If your organization isn’t actively fostering a speak-up culture, expect greater regulatory scrutiny and reputational risk.

How to foster a robust speak-up culture:

- Provide secure, anonymous reporting channels (hotlines, web portals, and SMS where supported) to protect whistleblower identities.

- Regularly communicate anti-retaliation policies and ensure visible enforcement to build trust.

- Ensure employees and managers are informed about internal reporting protections through clear policies and structured documentation.

- Ensure consistent case follow-up so whistleblowers see that concerns are taken seriously.

- Acknowledge the value of whistleblowers in maintaining organizational integrity and compliance.

- Use analytics to measure and continually improve whistleblower engagement and reporting rates.

If employees don’t feel safe speaking up internally, they’ll take their concerns elsewhere — whether to regulators, the media, or the courts. Build trust now, or risk losing control of the narrative.

Best practices to successfully manage whistleblower cases

As you’ve seen, the most effective ethics and compliance programs require structured processes, clear documentation, airtight compliance controls, and a secure, trusted platform to help meet the demands of global whistleblower laws. Every delayed investigation increases your risk of compliance failures and financial penalties.

If this feels complex, don’t worry. We’re here to make it easier. Resolver helps you automate, centralize, and secure your whistleblower case management — reducing legal exposure and strengthening regulatory confidence.

- Protect your organization from regulatory fines and reputational damage.

- Ensure compliance with global whistleblower mandates.

- Improve case resolution speed and risk visibility with workflow automation designed for ethics and compliance teams.

Regulators won’t wait. Why should you? Stay ahead with Resolver’s trusted platform, designed for ethics and compliance leaders. Book a demo today and see how Resolver can protect your organization.