Modern businesses know that focusing on what they do best and outsourcing the rest is key to success. Using third-party suppliers and vendors — for tasks like accounting, manufacturing, and even vendor risk assessments — reduces costs, boosts performance, frees up vital resources, and streamlines operations.

Outsourcing can increase efficiency and eliminate tedious or super complex tasks, but it also brings significant risks from third-party vendors. Large companies often struggle to manage multiple vendor relationships across siloed departments, leading to untracked risks and accountability issues. Adding Environmental and Social Governance (ESG) obligations can make risk avoidance even more complicated.

Optimizing your third-party risk management programs improves compliance and quality across your organization and protects your brand. Continuous, proactive vendor risk assessments promote transparency in third-party relationships, helping maintain smooth operations. But how do you get there if you’re just beginning?

Read on to learn about effective vendor risk assessments and how to implement them in your organization. Understand the core components and best practices for thorough vendor risk assessments so you can safeguard your organization from third-party vulnerabilities.

Discover Resolver's solutions.

Understanding vendor risk assessments

A vendor risk assessment evaluates potential risks from third-party suppliers. Vendor due diligence ensures that vendors meet all necessary standards and requirements.

The goal is to make sure vendors, suppliers, and other third-party providers meet the first-party’s compliance and quality standards, align with corporate objectives, and deliver on expectations and commitments. An effective vendor risk assessment can also help identify and prevent issues like ESG-washing, ensuring that your company’s initiatives are genuine and impactful.

According to a 2023 study, 90% of organizations have invested in third-party risk management programs. This highlights the growing importance of vendor risk assessments, including protecting a company’s operations, finances, and reputation. These assessments are key for:

- Risk Evaluation: Identifies potential risks that can affect a business operationally and financially.

- Regulatory Compliance: Makes sure that vendors follow relevant laws and standards, reducing legal liabilities. Effective supplier evaluation processes are essential here.

- Business Continuity: Supports continuity plans by managing and mitigating risks posed by third-party vendors.

- Reputation Management: Helps protect a company’s reputation by ensuring partners adhere to ethical practices.

- Strategic and Cultural Fit: Ensures the vendor aligns with your organization’s values and objectives, which is important for a successful and harmonious partnership.

- Financial Stability: Evaluating a vendor’s financial health can prevent disruptions and ensures that the vendor can fulfill long-term obligations.

Also read: The Ultimate Guide to GRC Software: How Integrated Solutions Enable Better Risk Outcomes

Key steps in conducting vendor risk assessments

Understanding the components of a vendor risk assessment can help your business manage these relationships more effectively and ensure due diligence. Let’s break down the essential parts:

- Vendor Identification: Start by compiling a comprehensive list of all third-party vendors your organization engages with. Knowing who you’re working with is the first step to managing those relationships effectively.

- Risk Evaluation: Evaluate the potential risks each vendor poses. Consider financial, operational, strategic, and reputational risks. It’s about anticipating challenges before they become problems.

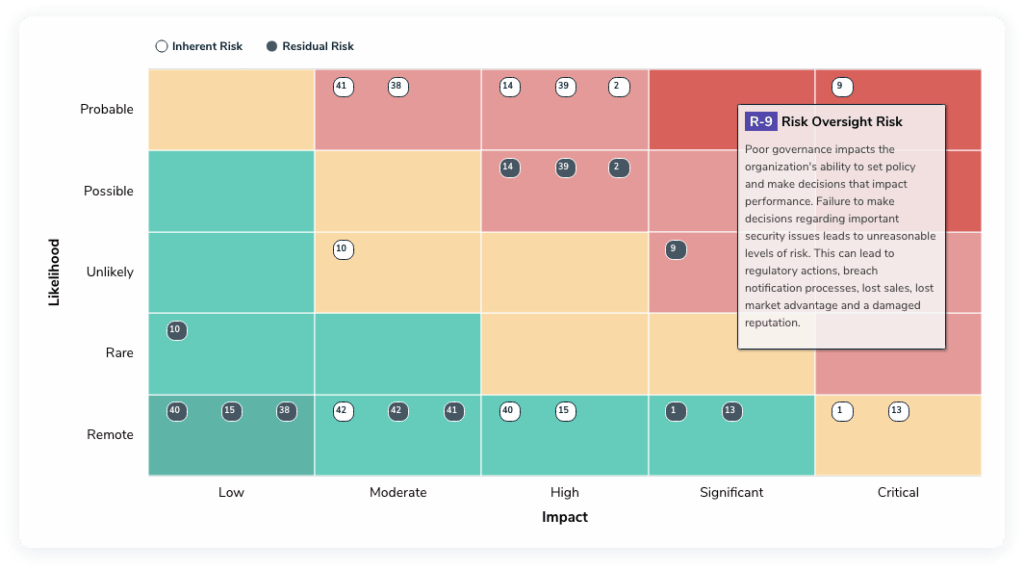

- Risk Categorization: Classify vendors based on their risk levels. A risk assessment heatmap or risk matrix can provide a clear visual representation. This helps prioritize which vendors need more attention.

- Documentation and Reporting: Keep detailed records of the assessment process, findings, and actions taken. Transparency is key, so ensure these records are accessible to all relevant stakeholders.

- Due Diligence: Conduct thorough background checks, obtain references, and ensure vendors comply with legal and regulatory requirements. Centralize these reviews and schedule regular updates. Prevention is better than cure.

- Contracts: Draft clear contracts that outline goals and include clauses to protect against identified risks. Specific and detailed contracts help avoid misunderstandings and set clear expectations.

- Ongoing Monitoring: Regularly evaluate vendor performance and compliance. Conduct quarterly business reviews (QBRs) to address any issues promptly. Continuous improvement is the name of the game.

- Vendor Management: Don’t just sign the contract and forget about it. Continuously monitor the relationship to maintain quality and reduce risks. Regular check-ins keep the partnership healthy.

- Incident Management: Establish protocols to manage and mitigate any issues that arise during the vendor relationship. Being prepared ensures quick and effective responses.

- Human Resources Management: Ensure proper onboarding and training for third-parties taking on roles that were previously under your human resources policies, so they understand your business standards and expectations. Well-prepared vendors are more likely to meet your needs.

- Contingency Planning: Develop backup plans and exit strategies to ensure business continuity if outsourcing efforts don’t go as expected. Being ready for the unexpected is crucial.

Incorporating these steps into your vendor risk management program enhances compliance, protects your reputation, and ensures smooth operations. Leveraging technology can streamline these processes, providing a centralized platform for managing third-party relationships and ensuring continuous monitoring and assessment.

Best practices for conducting vendor risk assessments

Conducting effective vendor risk assessments involves several best practices that help ensure thorough and proactive management of third-party risks. Implementing the below best practices not only strengthens your vendor risk management but also lays the groundwork for building a resilient, risk-based audit program.

Businesses can follow these guidelines to strengthen their third-party risk management processes and build more reliable partnerships with their vendors.

Define objectives and scope

Start by defining clear objectives and scope for your vendor risk assessment. Aligning plans with operational resilience frameworks helps set criteria for cybersecurity, IT management, and business continuity. Aligning these factors ensures that the assessment covers all necessary areas and meets your organization’s specific needs.

Understand and document third-party inventory

Keep a detailed record of all third-party relationships and their associated risks. Documenting your third-party inventory helps in tracking and managing each vendor. Providing a comprehensive view of your vendors, this practice makes it easier to identify potential risks and address them promptly.

Develop policies and procedures

Establish clear guidelines for managing vendor risks and ensuring compliance across all departments. Develop policies and procedures that outline the steps for conducting vendor risk assessments, including vendor selection, contract management, and ongoing monitoring. Regularly update these guidelines to reflect changing conditions and emerging risks.

Enhance ongoing monitoring

Regularly review and update vendor risk assessments to reflect current conditions and potential new risks. Continuous monitoring ensures that any issues are caught early, allowing for timely intervention. Use automated tools and platforms to support ongoing monitoring and make the process more efficient.

Implement technology and automation

Leverage technology and automation to streamline the vendor risk assessment process. Using tools and platforms to automate risk assessments improves data accuracy and reduces manual effort. Using this approach frees up resources for more strategic activities and enhances the overall efficiency of your third-party risk management program.

Streamline vendor interactions

Simplify vendor interactions with aggregated questionnaires and centralized communication. Streamlining the process makes it easier for vendors to comply and for businesses to manage the assessment. Use a user-friendly vendor portal to facilitate communication and document submission, improving collaboration and transparency.

Conduct regular training and awareness programs

Regularly train employees and vendors on the importance of vendor risk assessments and compliance standards. Awareness programs help ensure that all stakeholders understand their roles and responsibilities in the risk management process. Training sessions can cover best practices, common pitfalls, and the latest regulatory requirements.

Foster strong vendor relationships

Building and maintaining strong relationships with vendors is key to effective risk management. Engage with vendors regularly to discuss performance, address concerns, and collaborate on improvements. Strong partnerships lead to better compliance, reduced risks, and more successful outcomes for both parties.

Perform regular audits and reviews

Schedule regular audits and reviews of your vendor risk management program. Audits help identify gaps and areas for improvement, ensuring that your program remains robust and effective. Use audit findings to refine policies, procedures, and practices, continuously enhancing your vendor risk assessment process.

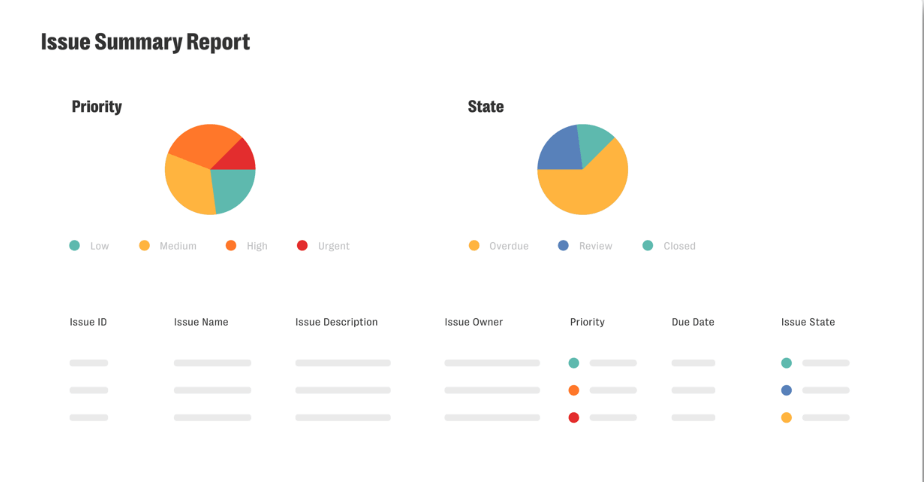

Internal Audit Findings Summary Report

Third-party risk solutions for effective vendor risk assessments

Managing vendor relationships and the associated third-party risks can be streamlined with the right technology. Resolver’s Third-Party Risk Management software offers an intuitive solution that simplifies the complex processes of vendor risk assessments.

Resolver’s Third-Party Risk Management software streamlines vendor relationships and associated risks. From vendor selection to onboarding, our custom risk assessments and workflow automation ensure accuracy and prompt issue resolution. Seamlessly integrating with other governance, risk, and compliance (GRC) applications, Resolver provides an enterprise-wide risk view, breaking down silos and boosting visibility. Our software empowers data-informed decisions, promoting growth while maintaining control and visibility over external partnerships. Optimize vendor selection, streamline onboarding, and manage third-party risk and compliance more effectively with Resolver.

Book your demo today and see how Resolver can simplify your vendor risk management process!