SEC scrutiny on marketing practices is intensifying — is your firm ready?

New enforcement trends and multi-million dollar fines are sending a clear message. This guide explains what’s changing, what the SEC is looking for, and how asset managers can reduce risk before a violation occurs.

Avoid SEC fines with a guide built for asset managers

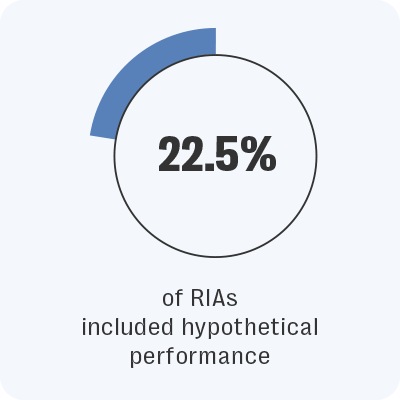

- SEC expectations for marketing performance: A detailed analysis of the latest SEC updates to the Marketing Rule, including advertising performance and hypothetical returns.

- Common violations firms are making: Insights into enforcement actions, highlighting common compliance gaps and costly mistakes.

- What RIAs can do to prepare: Practical observations to help RIAs and asset managers proactively prepare for SEC examinations.

About The Asset Manager’s Guide to the SEC Marketing Rule

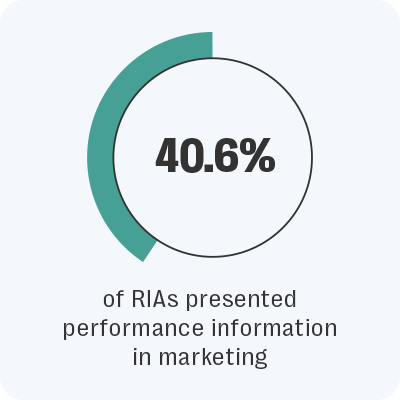

The SEC’s updated rule is reshaping how registered investment advisers promote performance, use testimonials, and disclose results. In September 2024, nine RIAs were fined a combined $1.24 million — the largest enforcement round since the rule took effect.

This guide draws on reviews of thousands of marketing materials by compliance professionals who support firms during exams, policy reviews, and enforcement response. It outlines the most common gaps and offers clear direction on what regulators expect to see.

Download the guide to see what’s changed and what to do next.