When a whistleblower report lands on your desk, the pressure is on. Workplace investigation mistakes can quickly derail even experienced teams, especially when evidence and investigative documents are scattered, deadlines are tight, and leadership is demanding fast results.

But rushing through an investigation often leads to missed details, compliance risks, and long-term setbacks. According to the latest Association of Corporate Investigators (ACi) White Paper. 66%of investigators face challenges accessing key evidence, while 53% experience internal pressure to close cases quickly—resulting in rushed or incomplete outcomes.

Without a structured process to guide workplace investigations from intake to resolution, small mistakes can spiral into larger issues. When investigations lack consistency, proper documentation, and alignment with business goals. demonstrating value becomes an uphill battle.

Let’s explore the 7 most common workplace investigation mistakes and how to fix them before they escalate.

- Mistake #1: Using the same intake form for all investigation types

- Mistake #2: Relying on disconnected tools to manage investigations

- Mistake #3: Failing to protect confidentiality during investigations

- Mistake #4: Letting “scope creep” derail investigations

- Mistake #5: Overlooking policy and risk alignment in investigations

- Mistake #6: Skipping or rushing case review

- Mistake #7: Poor communication across teams

Avoid these common investigation pitfalls. Download the Workplace Investigation Readiness Checklist to ensure every case is handled effectively from intake to resolution.

Mistake #1: Using the same intake form for all investigation types

One-size-fits-all intake forms may seem convenient, but they often leave investigators without the information they need to properly assess or prioritize cases. Fraud investigations may require transaction logs and financial data, while workplace misconduct reports rely on witness statements and policy violations.

According to the 2024 ACi White Paper, two-thirds of investigators report challenges gathering evidence due to incomplete information at the intake stage. Without tailoring forms, investigations face delays, missing details, and compliance risks.

Why generic intake forms delay workplace investigations

- Reports lack critical details, forcing investigators to spend time conducting follow-ups or repeat interviews.

- Delays in case resolutions occur when missing information prolongs investigations and increases the risk of missed legal deadlines.

- Compliance failures become more likely under regulations like the EU Whistleblower Directive, where incomplete or inaccurate data leads to non-compliance during audits.

How to tailor intake forms for more effective investigations:

- Match forms to investigation types:

Workplace misconduct cases differ from fraud investigations. Tailored forms ensure the right questions are asked upfront, reducing follow-ups and errors. - Standardize mandatory fields:

Ensure investigators capture critical details — such as dates, policy violations, and involved parties — by making them required fields. - Integrate compliance triggers: Customize fields for whistleblower cases to include privacy requirements, sensitive data classifications, and other regulatory triggers to maintain audit readiness.

- Provide clear guidance for whistleblowers:

Whistleblowers or complainants often don’t know what information investigators need. Step-by-step reporting instructions help employees submit complete, actionable reports and reduce follow-up investigations. - Conduct regular form audits:

Intake forms shouldn’t stay static. Regularly review and update forms to reflect evolving policies, regulatory requirements, and legal risks to the business. This ensures investigators consistently gather relevant, audit-ready information that meets current compliance standards.

Tailored intake forms give investigators a clear starting point, reduce delays, and ensure compliance without wasting time on backtracking.

“Security practitioners spend a lot of time doing what I call ‘bad admin’ — handling digital paperwork instead of conducting meaningful investigations and reducing risk within their organizations.” — Artem Sherman, Head of Security & Investigations, Resolver

Mistake #2: Relying on disconnected tools to manage workplace investigations

When key steps in an investigation, such as assigning cases, collecting evidence, or generating reports, are managed through disconnected tools like email, spreadsheets, or file-sharing platforms, investigators face delays, lost information, and increased compliance risks. Without a streamlined process and a centralized source of truth for sensitive information, investigators waste time chasing documents across multiple systems. Fragmented workflows remain a major issue—66% of investigators struggle to access case evidence when using disconnected tools.

The impact of siloed case evidence on workplace investigations

- Missed deadlines because investigators waste time searching for scattered files, leading to prolonged case resolutions and the risk of breaching legal timeframes.

- Incomplete documentation that results in non-compliance with whistleblower protection laws, which require accurate and timely recordkeeping.

- Data leaks and confidentiality risks when sensitive information is stored in unsecured channels, creating vulnerabilities under GDPR and other regulations.

How to eliminate gaps in investigation workflows

- Unify investigation management:

Manage all investigation-related tasks — intake, evidence gathering, collaboration, and reporting — within a secure, centralized platform to prevent lost or overlooked files. - Standardize data entry and task tracking:

Implement uniform processes for logging interviews, assigning tasks, and tracking milestones to prevent missing details. - Maintain secure access controls:

Ensure confidentiality through encrypted storage and role-based access controls, where only authorized personnel can view sensitive case details. Built-in audit logs automatically track data access, ensuring compliance and a defensible audit trail. - Automate case assignments and workflows:

Use configurable workflows that automatically assign cases to the right teams and trigger tasks, minimizing delays caused by manual processes. - Leverage relationship mapping:

Provide investigators with the ability to view linked incidents, individuals, and locations across cases, reducing investigative blind spots and improving overall outcomes. - Generate audit-ready reports:

Ensure your platform provides built-in dashboards to streamline reporting and maintain compliance documentation without the need for manual exports or external tools.

By centralizing investigation workflows, teams can reduce delays, safeguard sensitive data, and confidently meet compliance standards — without juggling disconnected tools.

Mistake #3: Failing to protect confidentiality during internal investigations

Without strict confidentiality, workplace investigations can lead to legal exposure and decreased whistleblower engagement. Twenty-nine percent of investigators in the ACi White Paper cited employee fears of confidentiality breaches as a significant barrier during corporate investigations. If employees don’t feel safe reporting issues, they may stay silent, allowing workplace misconduct or fraud to escalate.

Consequences of confidentiality breaches

- Whistleblower engagement declines and speak-up culture is compromised when employees lose trust in internal reporting channels to protect their identities.

- Regulatory fines and legal exposure arise from violations of GDPR and whistleblower protection laws, such as the EU Whistleblower Directive, which can result in fines of up to €50,000 and costly legal battles.

- Reputational damage erodes public trust, tarnishes the organization’s credibility, and creates long-term business harm.

“We’ve heard loud and clear that ethics and compliance teams are increasingly looking for secure, centralized platforms for handling whistleblower and ethics complaints. Without proper safeguards, organizations risk legal exposure and reputational harm.” — Artem Sherman, Head of Security & Investigations, Resolver

How to safeguard confidentiality and protect whistleblowers

- Adopt role-based access controls:

Restrict access to sensitive data by roles to ensure only authorized personnel can view case information. - Centralize and encrypt sensitive data:

Store whistleblower reports and evidence securely within a centralized platform, eliminating reliance on unsecured tools like email. - Ensure secure, anonymous reporting:

Offer whistleblowers encrypted reporting channels to protect their identities. - Monitor access through audit logs:

Automatically log who accesses or modifies case data to ensure compliance and build defensible audit trails. - Train teams on confidentiality protocols:

Regularly train investigators and key stakeholders to handle sensitive data properly and reduce the risk of human error.

By protecting confidentiality, you build the trust needed for employees to speak up — giving your organization the early warnings it needs to stay compliant and proactive.

Struggling with investigation inefficiencies? Our checklist outlines key steps to streamline your process. Get your copy now.

Mistake #4: Letting “scope creep” derail investigations

A focused investigation can quickly spiral when new issues emerge mid-process. What starts as a simple whistleblower complaint or misconduct report often expands into unrelated concerns — stretching timelines, increasing costs, and leading to unfocused outcomes — otherwise known as “scope creep”.

According to the ACi White Paper, one-fifth of investigators face scope creep due to pressure from departments like HR or legal. Without strict controls, investigations can miss deadlines, fail to meet compliance standards, or exhaust team resources.

Why scope creep causes costly delays

- Higher investigation costs arise when teams spend time pursuing unrelated leads instead of resolving the main case.

- Investigator burnout increases as shifting objectives and unclear priorities lead to overwhelming workloads.

- Compliance risks escalate when delays in whistleblower cases violate legal deadlines and regulatory expectations.

- Missed regulatory obligations leave organizations exposed to fines and penalties under regional compliance laws.

How to prevent investigation scope creep

- Define clear objectives upfront:

Identify key questions and objectives at the start. Tie the investigation to the specific policy violation or risk it addresses. - Get stakeholder alignment early:

Set expectations with HR, legal, and compliance teams to prevent last-minute additions. - Set guidelines for out-of-scope issues:

Not every discovery requires immediate investigation. Establish guidelines for documenting additional findings without compromising the main investigation. - Track and review progress regularly:

Regular status check-ins help ensure teams remain aligned on priorities. Document any justified changes to the scope to maintain an audit trail. - Use case management tools to stay on track:

Investigation management platforms with built-in workflows, status tracking, and progress reporting help prevent off-track detours. Built-in collaboration features ensure that new requests are reviewed and prioritized properly before disrupting progress.

Setting clear objectives and maintaining structured oversight can protect both investigative integrity and maintain regulatory compliance.

“Without clear scope boundaries, investigations can spiral into tangential, prolonged efforts. Successful teams know where to draw the line and protect the integrity of their work.” — Artem Sherman, Head of Security & Investigations, Resolver

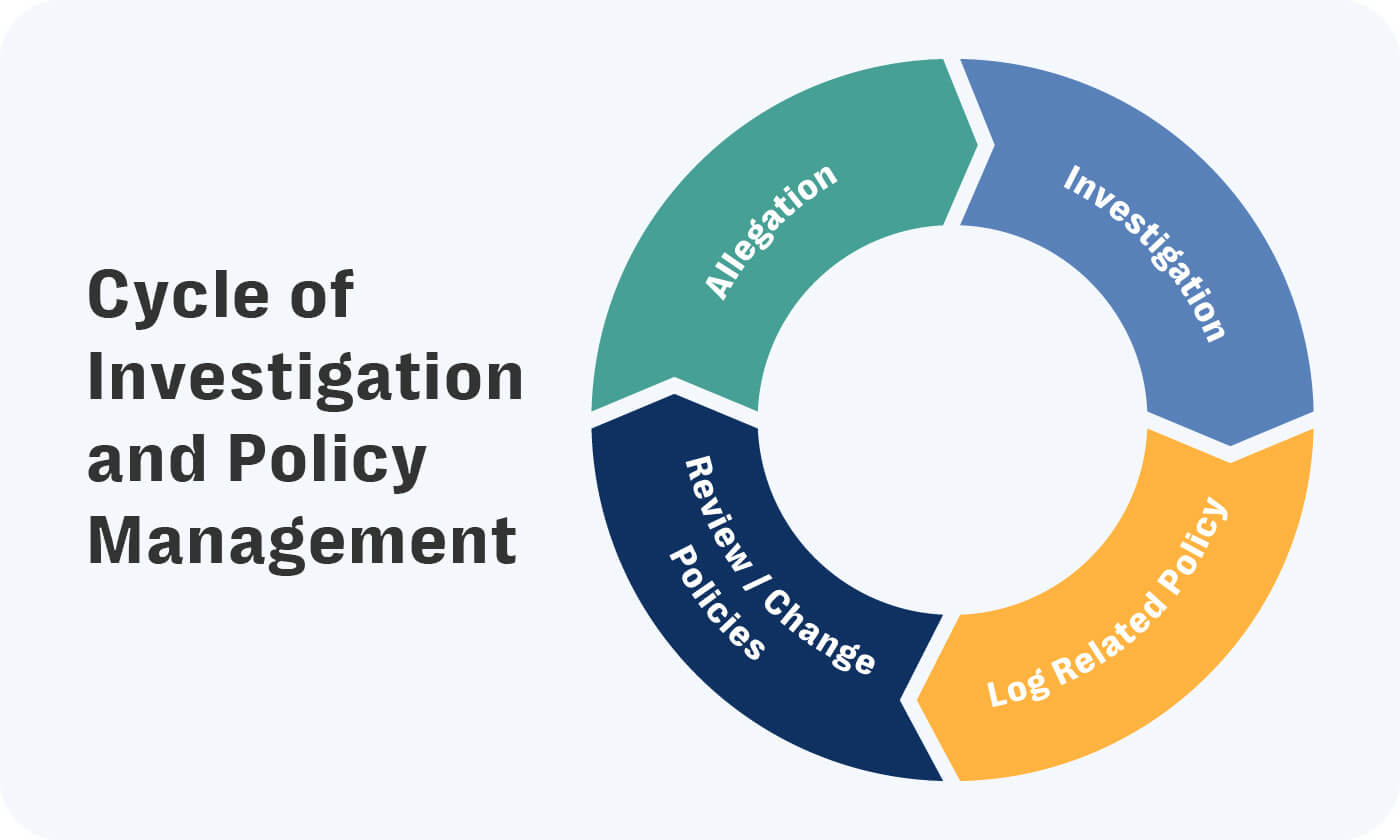

Mistake #5: Overlooking policy and risk alignment in corporate investigations

When investigations fail to align with organizational policies or key risks, they lose credibility and priority. Cases become disconnected from broader compliance and business goals, making it difficult to secure leadership buy-in or achieve long-term impact.

Nearly a quarter of investigators in the ACi White Paper cite insufficient senior-level support due to poorly communicated outcomes. When investigations don’t demonstrate how they address business risks, they’re often deprioritized — leading to unresolved misconduct and weakened risk management.

Why poor policy alignment undermines investigations

- Inconsistent disciplinary actions occur when investigations lack clear policy links, leading to employee distrust and potential legal claims.

- Missed compliance standards trigger fines and penalties when investigations fail to address policy violations or meet regulatory expectations.

- Limited risk mitigation leaves organizations exposed, as disconnected investigations miss opportunities to prevent future incidents or address vulnerabilities.

“Tie your goals to the business’s goals and objectives. Organizations that succeed at securing budget and executive buy-in do so by demonstrating how security contributes to commercial objectives — not just safety.” — Artem Sherman, Head of Security & Investigations, Resolver

How to align investigations with organizational policies and risks:

- Map every investigation to a relevant policy or risk from the start:

Identify the relevant policy violation, business risk, or regulatory obligation at the beginning. For example, link harassment cases to anti-harassment policies or fraud cases to financial controls. - Standardize policy-driven workflows:

Use templates and workflows that automatically incorporate relevant policies for consistent documentation and regulatory reporting. - Collaborate with risk management and legal teams:

Ensure investigation outcomes feed into larger risk mitigation strategies to help close compliance gaps across departments. - Ensure consistent, policy-driven outcomes:

Align corrective actions and disciplinary measures with the relevant company policy to promote fairness and accountability. Consistency helps reduce the risk of claims stemming from uneven enforcement or perceived bias. - Quantify impact through risk reduction metrics:

Look for tools with customizable dashboards to monitor key performance indicators (KPIs) and link investigation outcomes directly to business risks and policies. This enables proactive adjustments to compliance programs and strengthens organizational risk posture. - Review and update investigation processes regularly:

Conduct post-case reviews to identify recurring issues or gaps in enforcement. Regularly update investigation protocols to reflect lessons learned, ensuring that future cases are handled more efficiently and with greater impact.

Aligning investigations with organizational risks and policies ensures consistent, fair outcomes and positions your team as a key driver of long-term business success.

Mistake #6: Skipping or rushing case review

Under pressure to meet deadlines, many teams rush case reviews, leading to incomplete documentation and overlooked evidence. For ethics and compliance teams, this can result in unresolved issues resurfacing during audits — or worse, regulatory fines and reputational damage.

Over half of investigators in the 2024 ACi White Paper cite internal pressure to close cases quickly as a major challenge. This “speed over accuracy” approach creates long-term risks when critical evidence or procedural steps are missed.

“Investigators should focus on resolving cases, not wasting time on manual administrative work that could be automated.” — Artem Sherman, Head of Security & Investigations, Resolver

Why skipping case review leads to bigger problems

- Overlooked evidence leads to flawed conclusions and unresolved compliance risks, increasing the likelihood of repeat incidents.

- Incomplete documentation weakens audit trails, exposing organizations to regulatory fines and reputational harm during audits or legal challenges.

- Missed corrective actions prevent organizations from addressing systemic issues, leaving long-term risks unaddressed.

How to prioritize case reviews without wasting time:

- Block time for final case reviews:

Make it part of your standard workflow. Set aside 30 minutes to review evidence logs, case notes, and decisions before closure. It’s better to spend time now than to fix mistakes later. - Use standardized review checklists:

Is every interview logged? Is key evidence attached? Missing files could trigger legal issues or compliance violations when you least expect them. Ensure reports are audit-ready, with complete timelines and supporting details. - Review with legal or compliance teams:

A second review by legal or compliance professionals helps identify discrepancies or gaps in documentation. - Log final decisions and reasoning:

Summarize findings, corrective actions, and their rationale. Ensure decisions are defensible and helps leadership uphold decisions during audits or legal challenges. - Identify patterns to mitigate future risks:

Don’t just close the file. Use post-case reviews to uncover trends in misconduct or policy gaps and implement preventive measures to avoid repeat issues. - Use automated workflows to reduce admin tasks:

Investigators spend too much time on repetitive admin work that could be automated. Use structured workflows or case management tools to free up time for fact-finding and review, which has longer term impact on overall risk posture.

Thorough case reviews close the loop on investigations, reducing risks and ensuring your organization can defend its decisions with confidence.

Mistake #7: Siloed communication across teams

When departments like HR, compliance, and legal fail to share critical updates or align their priorities during investigations, key details fall through the cracks. The 2024 ACi White Paper highlights that one out five of investigators face major delays and complications due to miscommunication between departments. Without a timely coordination, teams duplicate efforts, miss evidence, and fail to meet regulatory deadlines — leaving the door open to costly penalties under regulations, like the EU Whistleblower Directive.

The impact of siloed communication on investigations

- Delays and inefficiencies occur when teams duplicate tasks or miss key updates, prolonging investigations and increasing costs.

- Missed compliance deadlines arise when teams fail to align on key tasks, leading to non-compliance with regulations.

- Weakened trust between departments can cause friction, reducing the effectiveness of future investigations.

Steps to improve cross-departmental collaboration

- Assign clear responsibilities:

Define which team handles tasks like evidence collection, legal review, and policy enforcement. Document these roles to ensure accountability. - Centralize communication channels:

Avoid scattered updates by using a centralized case management system. Built-in collaboration features streamline cross-department communication by providing shared access to case updates, tasks, and progress tracking on a need-to-know basis. - Centralizing investigation data:

Cross-functional teams should be able to access relevant case details without delays. Built-in relationship mapping ensures investigators can view previous incidents involving the same location or individuals, reducing duplicate investigations and improving overall efficiency. - Schedule regular status updates: Conduct milestone check-ins to discuss progress, address concerns, and maintain accurate documentation for audit-readiness.

- Set secure information-sharing policies:

Implement role-based permissions to prevent unauthorized access and protect sensitive data. - Develop post-investigation reviews:

Conduct debriefs to address communication gaps, identify recurring issues, and improve future investigations.

Stronger cross-department coordination helps teams reduce delays, minimize compliance risks, and work together for faster, more reliable case resolutions.

Take control of your workplace investigations

Effective workplace investigations require thoughtful processes to avoid costly mistakes. Organizations that streamline their approach don’t just resolve issues — they prevent future risks and improve overall compliance outcomes. Take control of your workplace investigations. Download our Workplace Investigation Readiness Checklist to ensure your team follows a structured, compliant approach every time.

Want to learn more about optimizing investigations? Discover how Resolver’s Whistleblowing & Case Management Software can streamline intake forms, centralize workflows, and deliver audit-ready reporting.