Comprehensive Risk and Compliance Software for Banks

Get real-time visibility across your bank's entire risk and compliance program while reducing testing time by 75%. Join leading financial institutions that trust Resolver to transform regulatory requirements into strategic opportunities.

Banking Risk & Compliance Software That Proves Its Value

Risk and compliance solutions tailored to banking needs

Managing Regulatory Compliance

Managing Regulatory Compliance

Banking institutions face an increasing volume of evolving regulatory obligations. Resolver’s automated compliance software ensures adherence to standards, reducing the risk of non-compliance and avoiding costly penalties. Stay ahead of regulatory changes with real-time updates, requirements summarizations, and comprehensive compliance tracking.

Learn more about our Regulatory Compliance Management Solution

Mitigating Operational Risks

Mitigating Operational Risks

Operational disruptions can lead to significant financial loss and reputational damage. Resolver’s risk management software helps identify, assess, and mitigate risks, ensuring business continuity and operational resilience. Our ERM software provides real-time risk insights and proactive risk mitigation strategies.

Combatting Financial Fraud Threats

Combatting Financial Fraud Threats

Fraudulent activities pose a substantial threat to financial stability. Resolver’s fraud risk assessment software helps detect, prevent, and mitigate fraud early, protecting your institution’s assets and reputation. Utilize advanced analytics and real-time monitoring to stay vigilant against financial fraud.

Overseeing Third-Party Risks

Overseeing Third-Party Risks

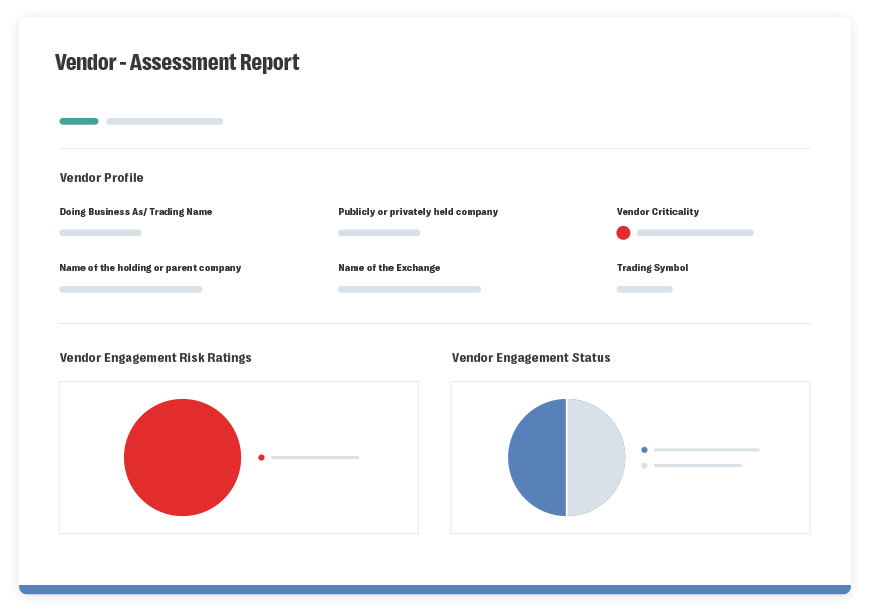

Third-party relationships can introduce significant risks if not properly managed. Resolver’s vendor risk management software provides comprehensive oversight throughout the vendor lifecycle, reducing overall risk exposure. Ensure vendor compliance, monitor performance, and manage risks effectively.

Stop Chasing Regulatory Updates. Start Leading Strategic Growth.

Transform your GRC program with automated testing, AI-powered regulatory feeds, and real-time dashboards. See why banks achieve $1.4M in regulatory savings and 75% faster compliance processes with Resolver.

Strengthen Operational Resilience

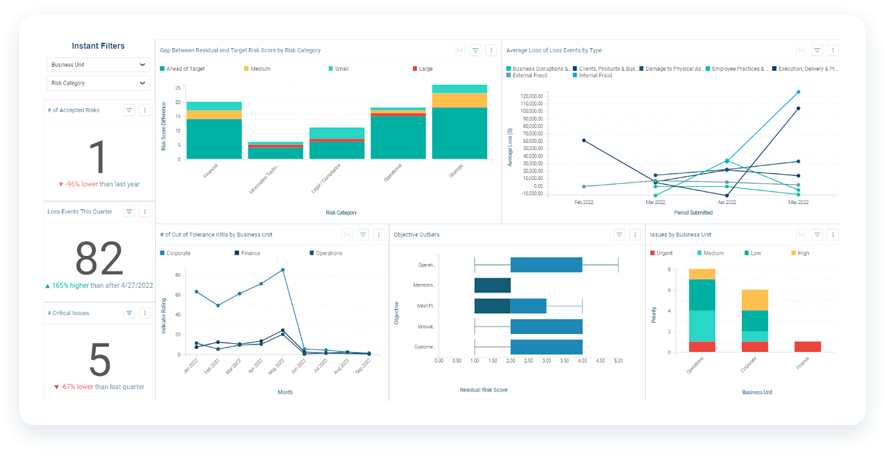

Identify and mitigate risks swiftly to minimize disruptions and ensure business continuity. Resolver’s real-time insights empower your team to act proactively, keeping your banking operations resilient and stable.

Reduce Regulatory Risk and Compliance Costs

Stay ahead of regulatory changes with Resolver’s automated compliance monitoring and reporting. Reduce compliance costs and avoid penalties while ensuring your institution adheres to evolving standards. Feel confident and secure in your regulatory posture.

Empower Agile Decision-Making

Equip your leaders with real-time risk data and comprehensive insights. Resolver’s solutions enable informed, strategic decisions, helping your institution navigate complex banking environments effectively. Experience the confidence of having risk intelligence at your fingertips.

Foster Collaboration and Engagement

Break down silos and enhance communication across your three lines with Resolver’s collaborative tools. Promote a cohesive risk management approach, ensuring all teams are aligned and motivated to work together efficiently. Experience the ease of unified controls and compliance efforts.

See how forward-thinking banks modernize their ERM & compliance programs

Schedule a DemoAdvanced Banking Risk and Compliance Software

Automated Compliance Monitoring

Stay ahead of regulatory changes with Resolver’s automated compliance monitoring, ensuring your institution adheres to evolving standards efficiently. Real-time updates and comprehensive tracking ensure adherence to evolving standards, reducing non-compliance risks and costly penalties by $1.4M in projected savings. Resolver’s compliance software automates processes, so your team can focus on strategic initiatives, resulting in improved efficiency and reduced compliance costs.

Streamlined Risk Assessments

Proactively identify and mitigate risks with Resolver’s streamlined risk assessments, safeguarding your institution’s stability and reputation. Consolidate risk data from various sources to get a holistic view of potential threats. By improving risk assessment processes with Resolver, your team can quickly address vulnerabilities, enhancing operational resilience and agile decision-making capabilities.

Comprehensive Third-Party Risk Management

Manage third-party relationships effectively with Resolver’s comprehensive third-party risk management software, proactively identifying and mitigating potential risks. Consolidate risk data from various sources to gain a holistic view of potential supplier risks. Streamline vendor risk assessment processes, allowing your team to address vulnerabilities quickly, ensuring operational resilience and informed decision-making.

Optimized Incident and Issue Management

Respond promptly to operational disruptions with Resolver’s optimized incident management, minimizing impact on your bank’s operations and maintaining customer trust. Track incidents in real-time, offering detailed insights into root causes and enabling swift resolution. By leveraging automated workflows and best-practice templates, your institution can ensure efficient incident handling, leading to a safer and more reliable banking environment.

Enhanced Audit Efficiency and Control

Enhance transparency and accountability with Resolver’s audit management software, elevating internal controls and audit efficiency across your institution. Support risk-based audits with real-time monitoring of internal controls. By identifying and addressing issues proactively, your institution can prevent escalation, ensuring compliance and operational excellence. Streamline the audit process to boost efficiency by 30% and reduce the burden on your audit team.

Learn How Leading Banks Strengthen Risk & Compliance with Resolver

How Bangor Savings Bank Used Resolver to Improve ERM Process Efficiency & Collaboration with Risk Owners

SC Ventures and Resolver: Simplifying and Automating Risk and Compliance

How a National Financial Institution Uses Resolver to Make Data-Driven Decisions for Effective Security

See Our Banking Software in Action

Join leading banks taking control of risk and compliance.